Here's Why You Should Retain DENTSPLY SIRONA (XRAY) Stock

DENTSPLY SIRONA XRAY is well poised for growth on a robust product portfolio and continued focus on research and development. However, forex remains a concern.

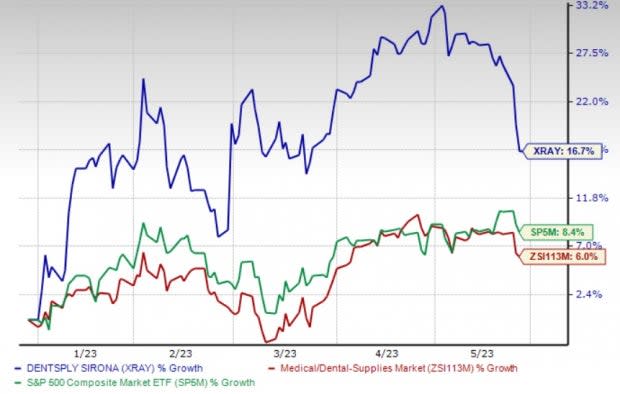

Shares of this Zacks Rank #3 (Hold) company have risen 16.7% so far this year compared with the industry's 6% growth. The S&P 500 Index has gained 8.4% in the same time frame.

XRAY, with a market capitalization of $7.89 billion, is a global leader in the design, development, manufacturing and marketing of dental consumables, dental laboratory products, dental specialty products and consumable medical device products. It anticipates earnings to improve 9.1% over the next five years.

Image Source: Zacks Investment Research

What's Favoring the Stock?

DENTSPLY SIRONA's introduction of PrimeScan, a digital impression scanner, and Primemill, among its other major products, have been driving the company's top line over the past couple of years. The company bolstered the consumable areas with Surefil one, Palodent 360 and the digital denture program. Its Astra EV Implant has been gaining momentum as well.

XRAY launched Primeprint — a medical-grade, highly automated 3D printer — in 2022 to enhance dentists’ workflow and practice efficiency. Apart from being an easy-to-use device, this 3D printer enables dentists to delegate tasks related to 3D printing to their staff.

Primeprint provides complete integration with the CEREC system and enables dentists to produce night guards, surgical guides, and full-scale models in a quick and inexpensive manner.

In 2021, DENTSPLY SIRONA launched ProTaper Ultimate, which is the first major endodontic platform innovation introduced in its endo business in more than five years. As part of a new platform, this will include new files of biosymmetric sealer and a new disinfection device.

Apart from this, the company will also introduce multiple new motor systems in the upcoming months. It will launch CEREC 5.2, a significant upgrade in Primescan, to further enhance speed and ease of use. This upgrade will support the new dental scanning capability and highlight Primescan in the marketplace.

During the first quarter, DENTSPLY SIRONA witnessed a huge demand for clear aligners, solid performance in Europe and continued strong demand for Imaging equipment.

XRAY also has an excellent new product pipeline that will aid its performance in 2023 and beyond. The company initiated a comprehensive review of its entire business in 2022 to improve execution, build a winning portfolio and return to growth. The completion of internal investigation removed a major overhang for XRAY.

What's Weighing on the Stock?

During the third quarter of 2022, DENTSPLY SIRONA recorded a non-cash charge for the impairment of goodwill and intangible assets worth $1.1 billion net of tax. The charge reflected the impact of macroeconomic factors like weakened global demand, higher cost of capital, unfavorable foreign currency impacts, and increased raw material, supply chain and service costs.

Macroeconomic headwinds, including foreign currency impacts, global supply chain challenges and regional softness continued in China and the United States.

Estimates Trend

The Zacks Consensus Estimate for 2023 revenues is pegged at $3.94 billion, indicating a 0.4% gain from the 2022 level.

The consensus mark for adjusted earnings per share stands at $1.91 for 2023, indicating a 8.6% year-over-year decline.

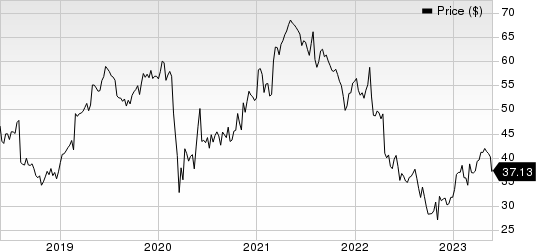

DENTSPLY SIRONA Inc. Price

DENTSPLY SIRONA Inc. price | DENTSPLY SIRONA Inc. Quote

Key Picks

Some better-ranked stocks from the broader medical space are Merit Medical Systems MMSI, West Pharmaceutical Services WST and Perrigo PRGO, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Merit Medical Systems has an estimated long-term growth rate of 11%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 20.22%.

So far this year, MMSI’s shares have risen 18.9% compared with the industry’s 8.7% growth.

West Pharmaceutical Services has an estimated long-term growth rate of 6.3%. Its earnings surpassed estimates in three of the trailing four quarters and missed the same once, the average surprise being 13.61%.

So far this year, WST’s shares have gained 49.1% compared with the industry’s 8.7% growth.

Perrigo’s earnings are expected to improve 24.2% in 2023. The strong momentum is likely to continue in 2024 as well. PRGO’s earnings surpassed estimates in two of the trailing four quarters and missed the same twice, the average negative surprise being 0.79%.

The company has lost 1.9% so far this year against the industry’s 4.8% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Perrigo Company plc (PRGO) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance