Here's Why You Should Retain FMC Corp (FMC) in Your Portfolio

FMC Corporation FMC is gaining from favorable demand for its herbicides and insecticides and its efforts to expand product portfolio and boost market position amid certain headwinds including higher input costs.

The company’s shares are down 1.7% over a year compared with the 14.7% decline of its industry.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Going in FMC’s Favor?

FMC Corp is benefiting from higher demand for its products, its portfolio strength and contributions of new products. The company is seeing healthy demand for its industry leading products, driven by strong global agricultural market fundamentals. The strong demand environment coupled with the company’s price increase actions is driving its top line. The company is actively taking price increase measures to mitigate the impact of cost inflation.

The company is well placed to capitalize on the underlying strength in global crop protection markets thanks to high commodity prices. It is seeing demand strength for diamides and insecticides in North America on higher crop commodity prices. Demand for Rynaxypyr brands continues to grow in the region. Strong demand is also being witnessed in corn, sugarcane and soybean applications in Brazil, aided by higher planted areas and high commodity prices. Demand for herbicides also remains strong in Australia. FMC Corp is also seeing strength in its insecticide portfolio in Asia.

FMC Corp also remains focused on boosting its market position and strengthening its product portfolio. It is investing in technologies and products as well as new launches to enhance value to the farmers. New products launched in Europe, North America and Asia are gaining significant traction and are contributing to volume growth. Product introductions are expected to support the company’s results this year.

The company also remains committed to return value to shareholders leveraging healthy cash flows. It expects to generate free cash flow of $515-$735 million in 2022. FMC Corp also expects to buy back stock worth $500-$600 million and pay dividends worth around $270 million in 2022.

A Few Concerns

FMC Corp faces headwinds from higher logistics and raw materials costs due to the intensified supply disruptions. The supply disruptions, exacerbated by the Russia-Ukraine conflict, have resulted in rising costs of some raw materials and active ingredients. Along with higher packaging costs, raw material and logistics costs are likely to remain elevated through 2022. Pandemic-related shutdowns in China and elevated energy costs in Europe are the other concerns. Higher raw materials and logistics costs might impact the company’s performance.

The company is also exposed to challenges from unfavorable currency swings. It is particularly challenged by currency headwinds associated with the weakening of European currencies. Currency headwinds are expected to drag the company’s performance in 2022.

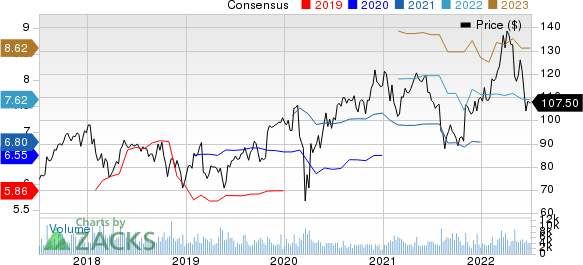

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Albemarle Corporation ALB, Cabot Corporation CBT and Nutrien Ltd. NTR.

Albemarle has a projected earnings growth rate of 231.7% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 112.4% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 20%. ALB has rallied roughly 18% in a year. The company flaunts a Zacks Rank #1 (Strong Buy).

Cabot, currently carrying a Zacks Rank #1, has an expected earnings growth rate of 22.5% for the current fiscal year. The Zacks Consensus Estimate for CBT's earnings for the current fiscal has been revised 6% upward in the past 60 days.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 9% over a year.

Nutrien, carrying a Zacks Rank #2 (Buy), has an expected earnings growth rate of 174.6% for the current year. The Zacks Consensus Estimate for NTR's current-year earnings has been revised 4.6% upward over the last 60 days.

Nutrien beat the Zacks Consensus Estimate for earnings in three of the last four quarters while missed once. It has a trailing four-quarter earnings surprise of roughly 5.8%, on average. NTR has gained roughly 26% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance