Here's Why You Should Retain Nutrien (NTR) in Your Portfolio

Nutrien Ltd. NTR is expected to benefit from higher demand for crop nutrients, its actions to reduce costs and strategic acquisitions amid headwinds from lower fertilizer prices.

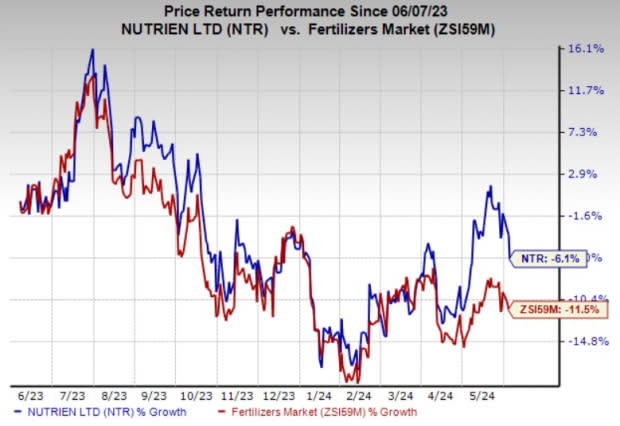

The company’s shares are down 6.1% over a year, compared with an 11.5% decline recorded by its industry.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

Healthy Demand, Acquisitions and Cost Cuts Aid NTR

Nutrien is well-positioned to benefit from increased demand for fertilizers, backed by the strength in global agriculture markets. It is seeing strong demand in its major markets, particularly North America. NTR’s sales volumes in North America rose in the first quarter of 2024, thanks to lower channel inventory and more typical purchasing behavior. Offshore sales volumes also saw a boost due to heightened demand in key international markets.

Strong grower economics, improved affordability and low inventory levels are expected to drive potash demand globally. The phosphate market is also benefiting from higher global demand and low producer and channel inventories. Demand for nitrogen fertilizer also remains healthy in major markets. Global nitrogen requirement is being driven by demand in North America, India and Brazil.

The company should also gain from acquisitions and increased adoption of its digital platform. It continues to expand its footprint in Brazil through acquisitions. NTR completed a number of acquisitions in 2023 and expects to continue pursuing targeted opportunities in its core markets this year.

Cost and operational efficiency initiatives are also expected to aid the company’s performance. It remains focused on lowering the cost of production in the potash business. The company has also announced a number of strategic actions to reduce its controllable costs and boost free cash flow. Lower natural gas costs are also contributing to a decline in its cost of goods sold.

Weaker Fertilizer Prices a Concern

Softer fertilizer prices are expected to weigh on the company’s performance. Prices of phosphate and potash have retreated since the back half of 2022 from their peak levels attained in the first half riding on the impacts of the Russia-Ukraine war and disruptions due to the sanctions in Belarus.

Global nitrogen prices have declined since the beginning of 2023 driven by a rise in global supply availability. Lower net fertilizer selling prices negatively impacted NTR’s financial results in the first quarter. Lower prices are expected to hurt the company’s sales and profitability in the near term.

Nutrien Ltd. Price and Consensus

Nutrien Ltd. price-consensus-chart | Nutrien Ltd. Quote

Stocks to Consider

Better-ranked stocks in the basic materials space include Axalta Coating Systems Ltd. AXTA, Carpenter Technology Corporation CRS and ATI Inc. ATI.

Carpenter Technology currently carries a Zacks Rank #1 (Strong Buy). CRS beat the Zacks Consensus Estimate in three of the last four quarters while matching it once, with the average earnings surprise being 15.1%. The company’s shares have soared roughly 105% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta Coating Systems, carrying a Zacks Rank #1, has a projected earnings growth rate of 26.8% for the current year. In the past 60 days, the consensus estimate for AXTA's current-year earnings has been revised upward by 5.9%. The company’s shares have gained roughly 16% in the past year.

ATI currently carries a Zacks Rank #2 (Buy). ATI beat the Zacks Consensus Estimate in each of the last four quarters, with the average earnings surprise being 8.3%. The company’s shares have rallied around 54% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance