Here's Why I Think Alpha FX Group (LON:AFX) Might Deserve Your Attention Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Alpha FX Group (LON:AFX). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Alpha FX Group

How Fast Is Alpha FX Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. I, for one, am blown away by the fact that Alpha FX Group has grown EPS by 50% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

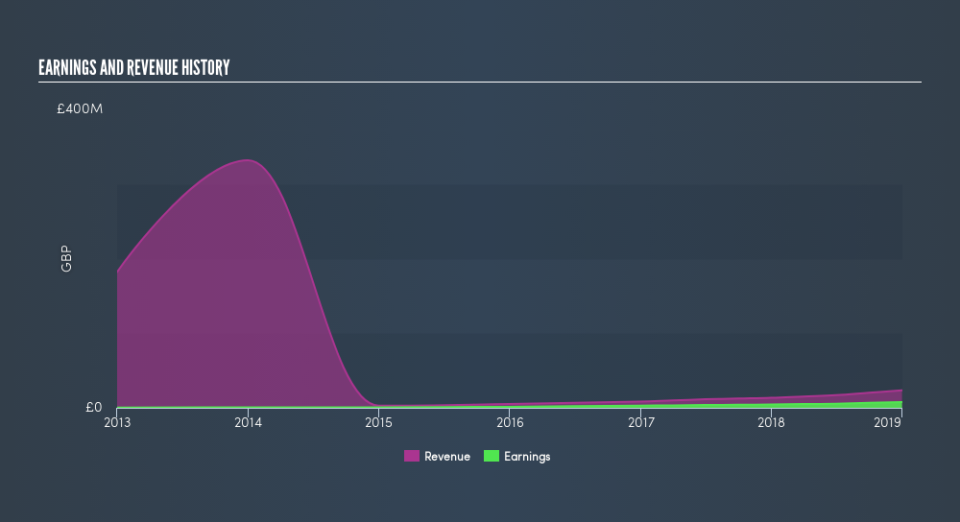

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Alpha FX Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Alpha FX Group Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Alpha FX Group insiders own a meaningful share of the business. Actually, with 44% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about UK£128m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Alpha FX Group with market caps between UK£158m and UK£630m is about UK£684k.

The Alpha FX Group CEO received total compensation of just UK£315k in the year to December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Alpha FX Group Worth Keeping An Eye On?

Alpha FX Group's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Alpha FX Group certainly ticks a few of my boxes, so I think it's probably well worth further consideration. Now, you could try to make up your mind on Alpha FX Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance