Here's Why I Think Alumasc Group (LON:ALU) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Alumasc Group (LON:ALU), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Alumasc Group

Alumasc Group's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Alumasc Group's EPS has grown 24% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

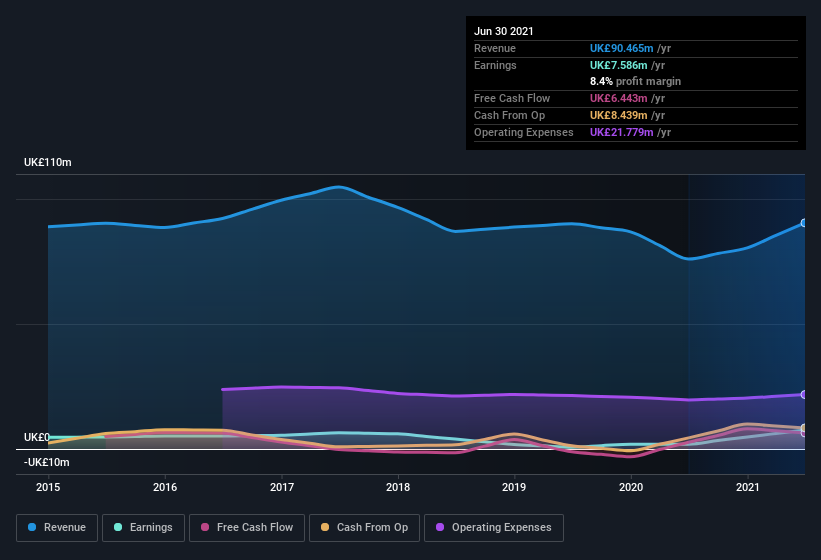

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Alumasc Group is growing revenues, and EBIT margins improved by 8.1 percentage points to 12%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Alumasc Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Alumasc Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Insiders both bought and sold Alumasc Group shares in the last year, but the good news is they spent UK£35k more buying than they netted selling. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director G. Hooper for UK£34k worth of shares, at about UK£2.58 per share.

The good news, alongside the insider buying, for Alumasc Group bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold UK£22m worth of its stock. That's a lot of money, and no small incentive to work hard. That amounts to 28% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Alumasc Group Worth Keeping An Eye On?

For growth investors like me, Alumasc Group's raw rate of earnings growth is a beacon in the night. On top of that, insiders own a significant stake in the company and have been buying more shares. So I do think this is one stock worth watching. What about risks? Every company has them, and we've spotted 1 warning sign for Alumasc Group you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Alumasc Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance