Here's Why We Think Aon (NYSE:AON) Is Well Worth Watching

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Aon (NYSE:AON). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Aon

Aon's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Who among us would not applaud Aon's stratospheric annual EPS growth of 39%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. This approach makes Aon look pretty good, on balance; although revenue is flattish, EBIT margins improved from 24% to 29% in the last year. That's something to smile about.

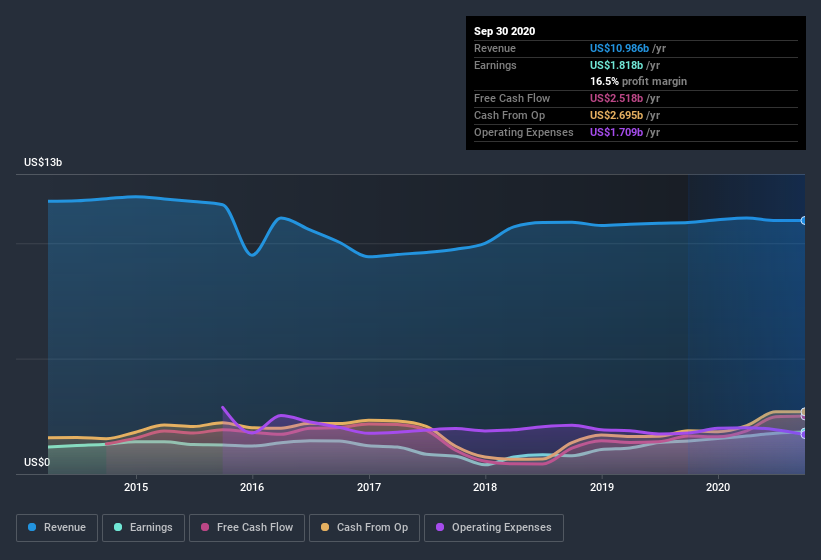

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Aon EPS 100% free.

Are Aon Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -US$5.0m worth of shares. But that's far less than the US$16m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Aon's future. It is also worth noting that it was Independent Non-Executive Chairman of the Board Lester Knight who made the biggest single purchase, worth US$14m, paying US$195 per share.

Along with the insider buying, another encouraging sign for Aon is that insiders, as a group, have a considerable shareholding. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$462m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Aon To Your Watchlist?

Aon's earnings per share have taken off like a rocket aimed right at the moon. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Aon deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Aon , and understanding it should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Aon, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance