Here's Why I Think Avingtrans (LON:AVG) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Avingtrans (LON:AVG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Avingtrans

Avingtrans's Improving Profits

In the last three years Avingtrans's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a falcon taking flight, Avingtrans's EPS soared from UK£0.075 to UK£0.10, over the last year. That's a impressive gain of 38%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Avingtrans's EBIT margins were flat over the last year, revenue grew by a solid 2.7% to UK£114m. That's a real positive.

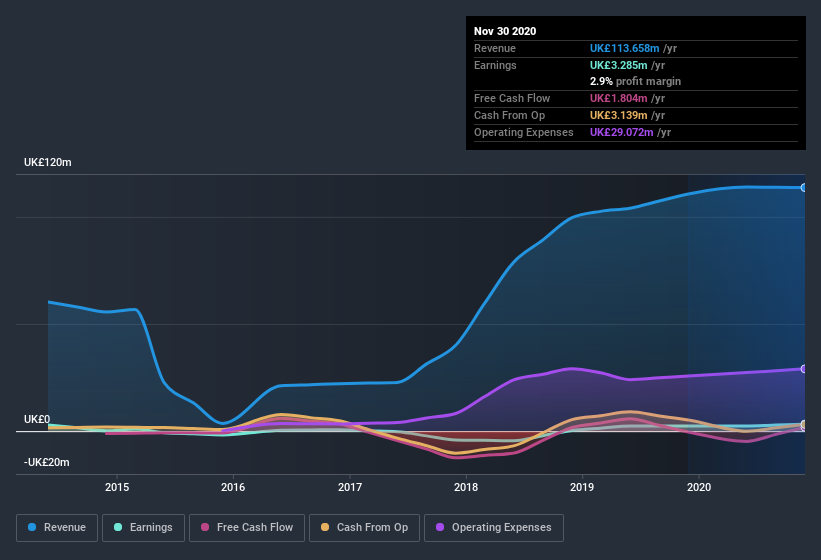

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Avingtrans?

Are Avingtrans Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that Avingtrans insiders have a significant amount of capital invested in the stock. Indeed, they hold UK£9.4m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 10% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Avingtrans To Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Avingtrans's strong EPS growth. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. Fast growth and confident insiders should be enough to warrant further research. So the answer is that I do think this is a good stock to follow along with. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Avingtrans.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance