Here's Why I Think Oxford Instruments (LON:OXIG) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Oxford Instruments (LON:OXIG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Oxford Instruments

How Fast Is Oxford Instruments Growing Its Earnings Per Share?

Over the last three years, Oxford Instruments has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Oxford Instruments's EPS shot from UK£0.32 to UK£0.59, over the last year. You don't see 84% year-on-year growth like that, very often.

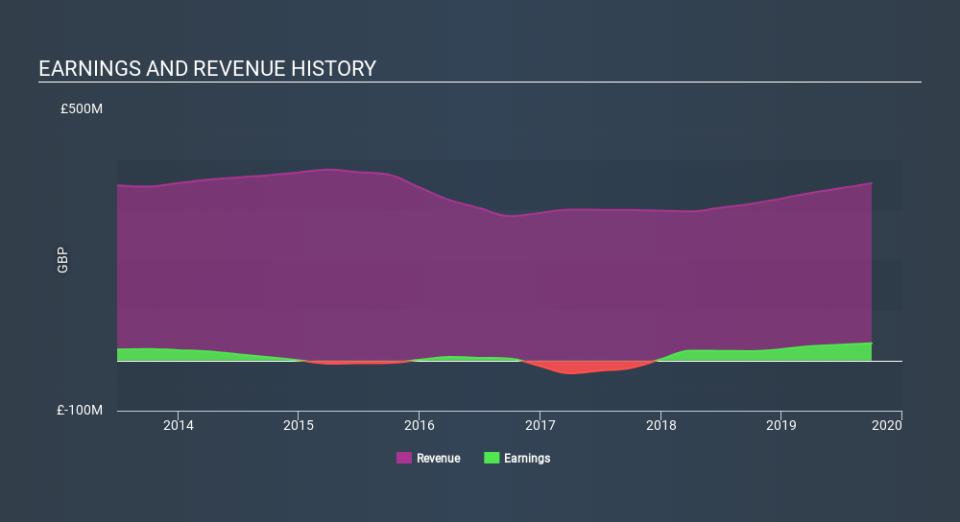

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Oxford Instruments's EBIT margins were flat over the last year, revenue grew by a solid 13% to UK£353m. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Oxford Instruments.

Are Oxford Instruments Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Oxford Instruments top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the UK£103k that Independent Chairman of the Board Neil Andrew Carson spent buying shares (at an average price of about UK£12.90).

On top of the insider buying, it's good to see that Oxford Instruments insiders have a valuable investment in the business. To be specific, they have UK£39m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 5.4% of the company; visible skin in the game.

Should You Add Oxford Instruments To Your Watchlist?

Oxford Instruments's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Oxford Instruments deserves timely attention. Even so, be aware that Oxford Instruments is showing 1 warning sign in our investment analysis , you should know about...

As a growth investor I do like to see insider buying. But Oxford Instruments isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance