Here's Why We Think Rentokil Initial (LON:RTO) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Rentokil Initial (LON:RTO). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Rentokil Initial

Rentokil Initial's Improving Profits

Over the last three years, Rentokil Initial has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Rentokil Initial's EPS soared from UK£0.10 to UK£0.14, in just one year. That's a impressive gain of 41%.

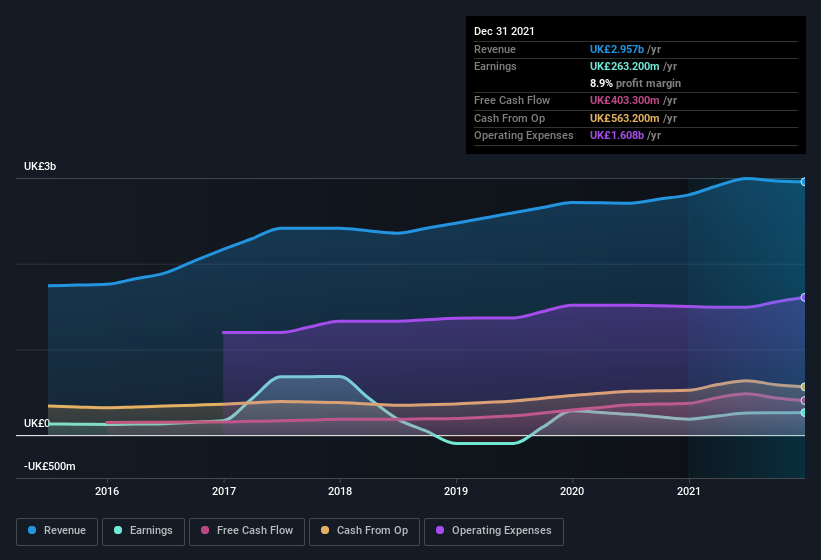

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Rentokil Initial's EBIT margins were flat over the last year, revenue grew by a solid 5.5% to UK£3.0b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Rentokil Initial's forecast profits?

Are Rentokil Initial Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's a pleasure to note that insiders spent UK£833k buying Rentokil Initial shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Andrew Ransom for UK£242k worth of shares, at about UK£5.38 per share.

On top of the insider buying, it's good to see that Rentokil Initial insiders have a valuable investment in the business. To be specific, they have UK£10m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.1% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Rentokil Initial Deserve A Spot On Your Watchlist?

You can't deny that Rentokil Initial has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 1 warning sign for Rentokil Initial that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Rentokil Initial, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance