Here's Why We Think Weir Group (LON:WEIR) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Weir Group (LON:WEIR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Weir Group

Weir Group's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. We can see that in the last three years Weir Group grew its EPS by 14% per year. That's a good rate of growth, if it can be sustained.

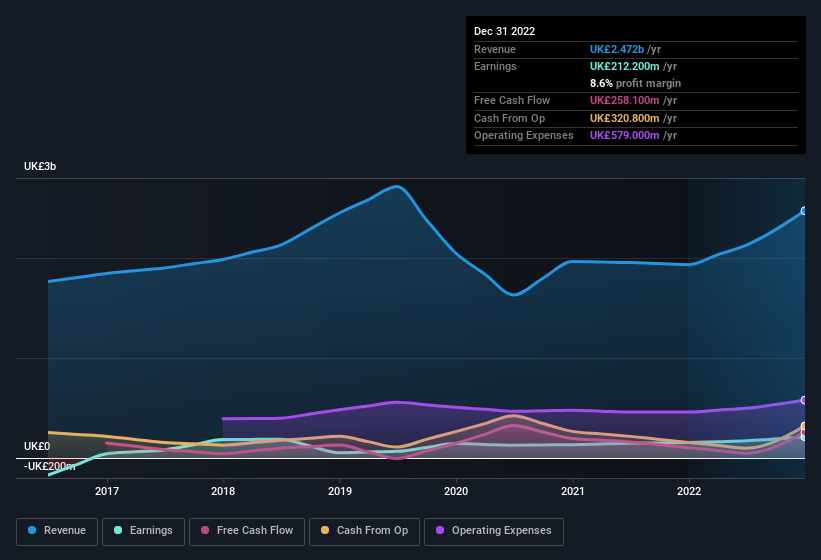

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Weir Group maintained stable EBIT margins over the last year, all while growing revenue 28% to UK£2.5b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Weir Group?

Are Weir Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

For the sake of balance, it should be noted that Weir Group insiders sold UK£35k worth of shares last year. But that doesn't beat the large UK£80k share acquisition by Independent Chairman Barbara Jeremiah. Overall, that is something good to take away.

Is Weir Group Worth Keeping An Eye On?

One positive for Weir Group is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Weir Group seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year; a point of interest for people who will want to keep a watchful eye on this stock. You should always think about risks though. Case in point, we've spotted 1 warning sign for Weir Group you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Weir Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance