Here's Why it's Worth Investing in Avery Dennison Stock Now

Avery Dennison Corporation AVY looks promising at the moment on the back of its stellar earnings performance in the June-end quarter, an encouraging 2019 outlook as well as anticipated benefits from organic revenue growth and restructuring activities. We are positive on the company’s prospects and believe this is the right time to add the stock to your portfolio, as it is poised to carry the bullish momentum ahead.

Avery Dennison’s shares have gained 9% over the past three months, outperforming the industry’s growth of 2.1%.

The company currently holds a Zacks Rank #2 (Buy) and a VGM Score of A. Our research shows that stocks with a VGM Score of A or B combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities.

Let's delve deeper into the factors that make Avery Dennison stock a compelling investment option at the moment.

Earnings Beat Consensus Mark in Q2:

Avery Dennison’s second-quarter 2019 adjusted earnings per share of $1.72 surpassed the Zacks Consensus Estimate and increased around 3.6% year over year.

Positive Earnings Surprise History

Avery Dennison outpaced the Zacks Consensus Estimate in three of the trailing four quarters, the average positive earnings surprise being 1.10%.

Upbeat Guidance

For 2019, Avery Dennison tightened its adjusted earnings per share guidance to $6.50-6.65, reflecting growth of 6-11% over 2018. Including the impact of the pension-settlement charge, the company tightened the earnings per share guidance to $3.15-$3.30 from the prior view of $3.10-3.35.

Rising Estimates

Earnings estimate revisions have the greatest impact on stock prices. The Zacks Consensus Estimate for Avery Dennison’s current-year earnings moved up around 0.3% over the past two months, reflecting analysts’ confidence in the stock.

Strong Earnings Prospects

The Zacks Consensus Estimate for Avery Dennison’s earnings for the ongoing year is currently pegged at $6.57, reflecting year-over-year growth of 8.42%. The same for third-quarter 2019 is pinned at $1.64, indicating year-over-year rise of 13.10%. The stock also has a long-term expected earnings per share growth rate of 8.30%, higher than the industry’s growth rate of 7.60%.

Growth Drivers in Place

Avery Dennison continues to deliver strong top-line growth, margin expansion and double-digit adjusted EPS improvement, driven by acquisitions, organic growth and strong presence in emerging markets. The company focuses on four overarching priorities, comprising driving outsized growth in high-value product categories, enhancing profitability in base businesses, relentlessly pursuing productivity improvement and a disciplined capital-management approach.

Avery Dennison’s Label and Graphic Materials (LGM) segment will maintain its momentum of stellar top-line growth and continued margin expansion, aided by growth in emerging markets, focus on high-value categories (including specialty labels), as well as contributions from productivity initiatives. Furthermore, the completion of restructuring actions associated with the consolidation of its European footprint will bring in higher returns and boost the segment’s competitiveness.

The company will also benefit from its fast-growing high-value product categories, such as specialty labels and Radio-frequency identification (RFID). Avery Dennison anticipates strong engagement among apparel retailers and brands, as well as promising early-stage developments in other end markets. Moreover, the company increases its investments to fuel growth with higher spending for business development and R&D.

Avery Dennison is confident about meeting its growth and margin targets for the Industrial and Healthcare Materials (IHM) segment over the long haul. It is likely to meet its target of 4-5% plus organic growth for the segment over the long term and anticipates to witness the company’s margin gradually expand by 2021.

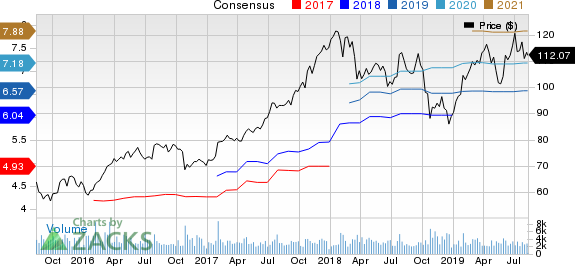

Avery Dennison Corporation Price and Consensus

Avery Dennison Corporation price-consensus-chart | Avery Dennison Corporation Quote

Other Stocks to Consider

Some other top-ranked stocks in the Industrial Products sector are Unifirst Corporation UNF, Albany International Corporation AIN and Cintas Corporation CTAS. While Unifirst flaunts a Zacks Rank #1, Albany International and Cintas carries a Zacks Rank of 2, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Unifirst has a projected earnings growth rate of 15.17% for the current year. The stock has gained 7% in a year’s time.

Albany International has an estimated earnings growth rate of 32.3% for 2019. The company’s shares have gained 10% in the past year.

Cintas Corporation has an expected earnings growth rate of 11.15% for the ongoing year. The stock has appreciated 26% over the past year.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Unifirst Corporation (UNF) : Free Stock Analysis Report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

Albany International Corporation (AIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance