Hewlett Packard Completes Cray Buyout to Boost HPC Footing

Hewlett Packard Enterprise HPE completed the buyout of supercomputing leader Cray for a deal value of approximately $1.4 billion.

The integration of HPE and Cray is expected to enhance future offerings and boost customer benefits. By ramping up R&D infrastructure and proficiency, the deal is likely to help accelerate the development of new products and solutions.

Management expects the deal to offer a wide-ranging end-to-end portfolio across compute, storage, software and services in high-performance computing (HPC) and AI markets.

Further, HPE expects to achieve significant synergies from the acquisition next year. It is likely to be accretive to its non-GAAP operating profit and earnings in fiscal 2020.

Eye on HPC: A Positive

HPE’s focus on strengthening its foothold in the HPC market is likely to get a boost from the acquisition of Cray. Customer wins by both companies are a tailwind in this regard.

Last month, Cray announced that it won a contract valued at $600 million to build the exascale supercomputer El Capitan for the National Nuclear Security Administration (NNSA) and Lawrence Livermore National Laboratory (LLNL). The system is based on Cray’s Shasta supercomputing architecture.

Reportedly, Cray is developing two more exascale supercomputers for the DOE, Argonne National Laboratory and Oak Ridge National Laboratory. Notably, Cray has won more than $1.5 billion in bookings so far for its Shasta-based systems.

Meanwhile, HPE joined NASA’s Ames Research Center for a four-year, multi-phase collaboration to build a new supercomputer named Aitken based on the HPE SGI 8600 system. The system is expected to help drive the researchers’ mission of landing the first woman and the next man on the moon by 2024.

We therefore believe that by combining HPE with Cray’s resources, both companies will be able to reap benefits of the growing HPC market. The HPC market and associated storage and services are likely to increase from nearly $28 billion in 2018 to around $35 billion in 2021.

Per a Grand View Research report, the HPC market is projected to witness a CAGR of 7.2% (2018-2025) and reach $59.65 billion by 2025.

Moreover, by fortifying its HPC presence, HPE’s economic moat against the rival companies like International Business Machines IBM and Dell DELL is also anticipated to get a stimulus.

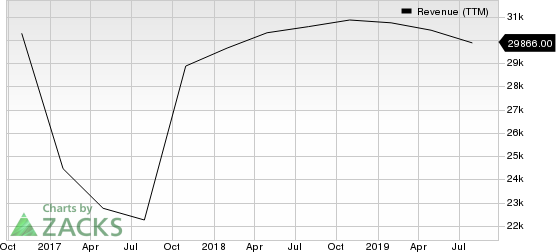

Hewlett Packard Enterprise Company Revenue (TTM)

Hewlett Packard Enterprise Company revenue-ttm | Hewlett Packard Enterprise Company Quote

Zacks Rank and Stock to Consider

Currently, HPE has a Zacks Rank #3 (Hold). A better-ranked stock in the broader technology sector is Perficient PRFT, flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Perficient is currently projected to be 10.8%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Perficient, Inc. (PRFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance