Hewlett Packard (HPE) Looks to Lead 5G Infrastructure Race

Hewlett Packard Enterprise HPE is taking robust steps to bolster its position in the 5G infrastructure market. The company’s 5G portfolio strives to leverage the potential of 5G at the network core, at the edge, and in the enterprise.

Recently, it launched the Open Distributed Infrastructure Management program along with an enterprise offering to complement the initiative, in collaboration with Intel INTC. The initiative aims to improve the management of large-scale geographically distributed physical infrastructure deployments. This move highlights the company’s leadership in open 5G technologies through open source innovation. The initiative is backed by AMI, Apstra, Red Hat, Tech Mahindra and World Wide Technology.

Contrary to the previous generation networks, 5G leverages open software platforms operating on commercial servers. This will lead the market to open distributed technologies like virtualized radio access networks (vRAN), multi-access edge computing (MEC) and cloud-native network functions, for which industry standard compute, storage and networking infrastructure will be required from multiple vendors across numerous geographically distributed locations.

Currently, there are very few data center physical infrastructure management solutions that accommodate geographical distribution or support multi-vendor deployments. Open Distributed Infrastructure Management addresses these requirements and challenges faced by telecommunications in deploying 5G networks across numerous locations.

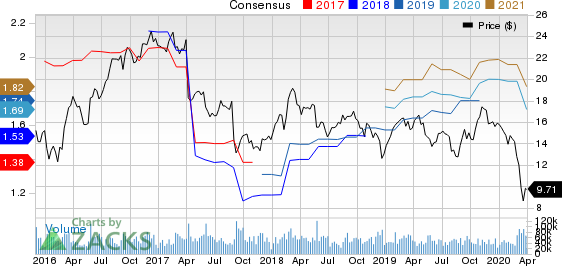

Hewlett Packard Enterprise Company Price and Consensus

Hewlett Packard Enterprise Company price-consensus-chart | Hewlett Packard Enterprise Company Quote

Prospects in the 5G Space

5G is set to proliferate in 2020. The fifth-generation mobile network is touted to revolutionize the way in which we interact with technology, facilitating faster download speeds and seamless transfer of data.

Per Cisco’s Annual Internet Report, by 2023, the average 5G speed will be 575 megabits per second or 13 times faster than the average mobile connection.

Notably, the global 5G technology market is estimated to be $5.53 billion in 2020 and reach $667.90 billion by 2026, at a CAGR of 122.3%, per an Allied Market Research report. Moreover, the 5G infrastructure market is expected to witness a CAGR of 67.1% to reach $47.78 billion by 2027, per a Research and Markets report.

Hewlett Packard has more than 30 years of experience in the telecommunications industry, with more than 300 customers globally. For its endeavors in the 5G space, the company was recently awarded by Frost & Sullivan with the 2019 Leadership award for Global 5G Infrastructure Enabling Technology.

Notably, Hewlett Packard is currently integrating 5G and mobile edge computing on a powerful cloud-based solution called Aruba Central, which will be delivered through its GreenLake model.

Further, in March, the company launched a new portfolio of as-a-service offerings to help telecommunications companies build and deploy open 5G networks. HPE's edge-to-cloud platform as-a-service strategy is expected to help telecommunications companies utilize a cloud-native software stack for 5G core, optimized telco core and edge infrastructure blueprints, and Wi-Fi 6-enabled services.

Competition Intensifies

The appealing outlook of the 5G space is attracting strong competition from industry stalwarts such as Qorvo QRVO, which is currently supplying products for more than 20 5G field trials. The company has introduced Front-End Modules that can function on both pre-5G and 5G architecture. Its GaN technology also enables FEMs to support the emerging 5G infrastructure.

Skyworks SWKS is another major competitor, offering a broad portfolio of RF solutions used in infrastructure, aerospace and the IoT ecosystem. These solutions are designed for global 5G Massive IoT network deployments in low-band and mid-band frequencies, in addition to providing 2G backward compatibility, either natively or through auxiliary ports.

Final Note

In its last earnings call, Hewlett Packard cited that its supply chain has been disrupted due to the coronavirus outbreak in China. Furthermore, organizations are pushing back their big and expensive technology products due to a slowdown in global economic growth. Additionally, more and more organizations continue to shift to cloud computing owing to its maintenance-free and cost-effectiveness compared with standalone servers.

Besides, a slowdown in IT spending primarily due to the coronavirus outbreak, as estimated by IDC, has raised concerns regarding the company’s near-term prospects. Hewlett Packard currently carries a Zacks Rank #5 (Strong Sell).

Nonetheless, with a strong position in the 5G space, given the sound prospects of the industry, Hewlett Packard is likely to withstand competition and tide over uncertain times.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance