Hexcel Corp (HXL) Q1 2024 Earnings: Adjusted EPS Meets Estimates, Revenue Slightly Misses

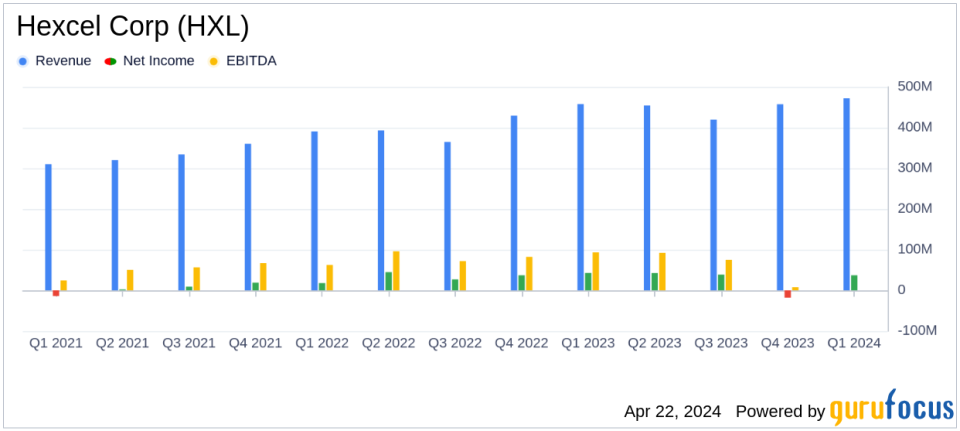

Q1 2024 Revenue: $472.3 million, a 3.2% increase from Q1 2023, slightly below the estimate of $473.78 million.

Q1 2024 Net Income: $36.5 million, down 14.5% from Q1 2023, slightly above the estimate of $36.30 million.

Q1 2024 EPS: Reported GAAP diluted EPS of $0.43, adjusted diluted EPS of $0.44, both surpassing the estimated EPS of $0.41.

Operating Income: Decreased by 15.8% to $52.9 million in Q1 2024 from $62.8 million in Q1 2023.

Free Cash Flow: Negative $35.7 million in Q1 2024, an improvement from negative $41.5 million in Q1 2023.

Share Repurchases: $100.7 million used for repurchasing shares in Q1 2024, with $386.4 million remaining under the current authorization.

2024 Full-Year Guidance: Reaffirmed, with expected sales between $1.925 billion and $2.025 billion and adjusted diluted EPS of $2.10 to $2.30.

On April 22, 2024, Hexcel Corp (NYSE:HXL), a leader in advanced lightweight composites technology, announced its first-quarter results for the year. The company reported an adjusted diluted earnings per share (EPS) of $0.44, aligning with analyst expectations of $0.41, and posted revenues of $472 million, narrowly missing the estimated $473.78 million. For more details, refer to the company's 8-K filing.

Founded in 1948, Hexcel designs and manufactures high-performance composite materials used primarily in commercial aerospace, defense, and other industrial markets. The company is renowned for its engineered solutions that offer superior strength and light weight, essential for efficient aircraft performance. Hexcel's significant clients include industry giants like Airbus and Boeing, making its financial health a key indicator of broader aerospace and defense sector trends.

Quarterly Financial Highlights

The first quarter of 2024 saw Hexcel achieving a net income of $36.5 million, a decrease from the previous year's $42.7 million. This decline is reflected in a 14.5% decrease in net income and a 14% decrease in diluted net income per share year-over-year, with the current figures standing at $0.43 per share compared to $0.50 in Q1 2023.

Despite these challenges, the company's sales increased by 3.2% to $472.3 million, up from $457.7 million in the previous year, driven by a robust performance in the commercial aerospace sector, which saw a 5.2% increase in sales. However, the industrial sector experienced a significant downturn, with sales dropping by 27.9%.

Operational and Market Challenges

Hexcel's operational income also saw a reduction, with a reported $52.9 million compared to $62.8 million in the same quarter the previous year, marking a 15.8% decrease. This decline in profitability can be attributed to various market and operational challenges, including fluctuating demand across different sectors and ongoing global economic pressures.

The company's Chairman, CEO, and President, Nick Stanage, commented on the market dynamics, noting the recovery in global air passenger traffic and the consequent rise in demand for new, lightweight, fuel-efficient aircraft. This trend underscores the importance of Hexcel's composite products in the aerospace industry.

Financial Position and Future Outlook

Hexcel's balance sheet remains robust with $85.9 million in cash and cash equivalents. The company's commitment to returning value to shareholders is evident from the $113 million returned through share repurchases and dividends in Q1 2024. Looking ahead, Hexcel reaffirms its full-year 2024 guidance, anticipating sales between $1.925 billion and $2.025 billion and adjusted diluted EPS between $2.10 and $2.30.

The company also projects a free cash flow of over $200 million and capital expenditures of less than $100 million, alongside an effective tax rate of 22.0%. These projections reflect Hexcel's strategic focus on growth, margin expansion, and cash generation.

Conclusion

While facing certain challenges, Hexcel Corp's strategic positioning and focus on high-performance aerospace and defense applications continue to drive its market relevance and financial stability. The company's ability to align closely with industry recovery trends and customer demands will be crucial in sustaining growth and profitability in the upcoming periods.

For detailed financial figures and further information, investors and stakeholders are encouraged to refer to the full earnings report and supplementary financial documents provided by Hexcel.

Explore the complete 8-K earnings release (here) from Hexcel Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance