High Growth LSE Stocks For The Day

Want to add more growth to your portfolio but not sure where to look? Companies such as St. James’s Place and Conygar Investment are deemed high-growth by the market, with a positive outlook in all areas – returns, profitability and cash flows. If a buoyant growth prospect is what you’re after in your next investment, I’ve put together a list of high-growth stocks you may be interested in, based on the latest financial data from each company.

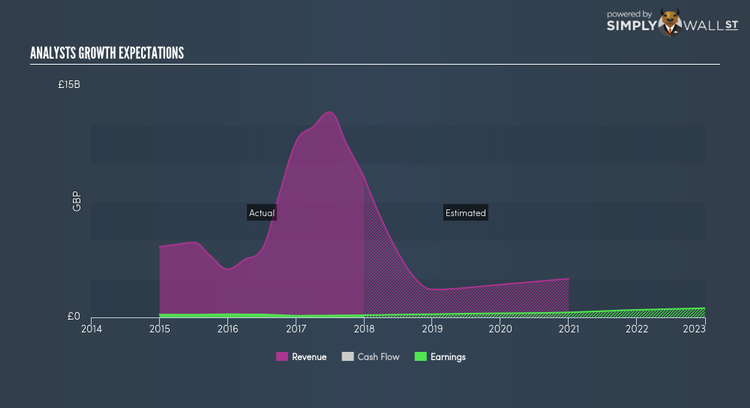

St. James’s Place plc (LSE:STJ)

St. James’s Place plc is a publicly owned investment manager. Started in 1991, and headed by CEO Andrew Croft, the company size now stands at 2,155 people and with the market cap of GBP £6.39B, it falls under the mid-cap stocks category.

STJ’s projected future profit growth over the upcoming years is a robust 20.92%, raising up from the present profit levels of UK£145.90M. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 24.62%. STJ’s bullish prospects on its profitability make it an interesting stock to invest more time to understand how it can add value to your portfolio. Could this stock be your next pick? Other fundamental factors you should also consider can be found here.

Conygar Investment Company Plc (AIM:CIC)

The Conygar Investment Company PLC (“Conygar”) is an AIM quoted property investment and development group dealing primarily in UK property. Conygar Investment was started in 2003 and has a market cap of GBP £111.47M, putting it in the small-cap category.

Driven by exceptional sales, which is expected to more than double over the next few years, CIC is expected to deliver an excellent earnings growth of 94.16%. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. CIC’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Interested to learn more about CIC? I recommend researching its fundamentals here.

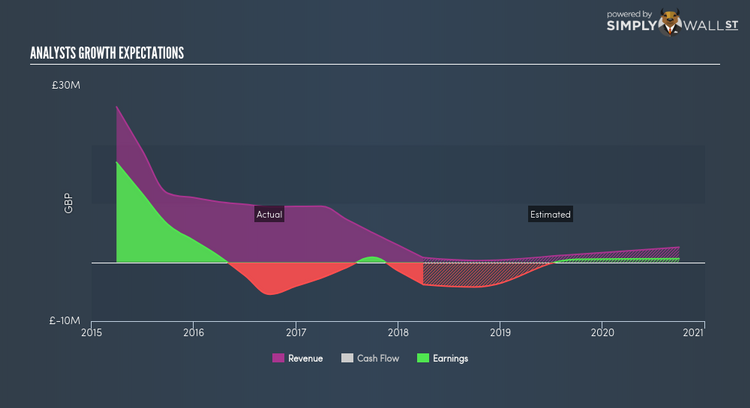

LiDCO Group plc (AIM:LID)

LiDCO Group Plc develops, manufactures, and sells hemodynamic monitoring equipment in the United Kingdom, the United States, Continental Europe, and internationally. Formed in 1991, and headed by CEO Matthew Sassone, the company size now stands at 49 people and has a market cap of GBP £18.92M, putting it in the small-cap stocks category.

LID’s projected future profit growth is an exceptional 97.89%, with an underlying 38.53% growth from its revenues expected over the upcoming years. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 21.46%. LID’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Considering LID as a potential investment? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance