Will Higher Ad Revenues Aid Meta Platforms (META) Q1 Earnings?

Meta Platforms’ META first-quarter 2024 results, set to be reported on Apr 24, are expected to reflect the benefits of higher advertising revenues.

It is expected to benefit from strong demand from advertisers. The Zacks Consensus Estimate for Meta Platform’s first-quarter advertising revenues is pegged at $35.589 billion, indicating growth of 26.6% year over year.

In the fourth quarter of 2023, advertising revenues (99.1% of Family of Apps revenues) increased 23.8% year over year to $38.71 billion and accounted for 96.5% of revenues.

Meta Platforms’ nearest competitor for ad dollars, Alphabet GOOGL, is expected to have benefited from its plan to infuse with generative AI technology.

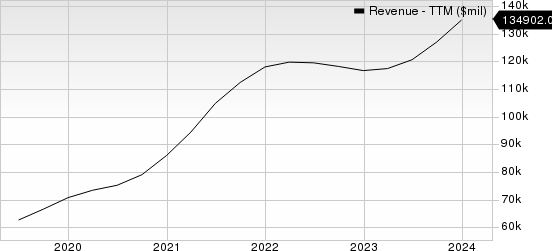

Meta Platforms, Inc. Revenue (TTM)

Meta Platforms, Inc. revenue-ttm | Meta Platforms, Inc. Quote

The consensus mark for Alphabet’s advertising revenues is pegged at $60.18 billion, indicating growth of 10.3% from the reported figure in the prior-year quarter.

Meta Platforms’ focus on improving ad ranking and measurement by leveraging AI has been a key catalyst driving advertisers’ return on investment.

The Zacks Consensus Estimate for advertising revenues in Asia-Pacific is pegged at $7.297 billion, indicating growth of 23.8% in the first quarter of 2024.

The consensus mark for advertising revenues in Europe, United States and Canada and the Rest of the World is pegged at $8.185 billion, $16.126 billion and $4.144 billion, indicating 30.6%, 27% and 28.3% growth, respectively.

Click here to know how Meta Platforms’ overall first-quarter performance is likely to be.

Reels Driving Prospects

The company, which currently carries a Zacks Rank #2 (Buy), is expected to have benefited from Instagram’s growing popularity in international markets, particularly in Asia. Much of it can be attributed to the growing popularity of short-form videos, Reels on Instagram.

Reels have been attracting Gen-Z to the platform amid competition from Snapchat, X and TikTok. AI has helped in improving recommendations, which drove a more than 40% increase in time spent on Instagram.

Threads growth has been noteworthy for Meta Platforms. The company has been focusing on the retention of users, which is expected to have benefited user growth.

Meta has been leveraging gen AI to boost user experience across its apps. AI stickers, AI-based editing tools, advanced conversational assistant — Meta AI — and others to improve user engagement.

It has been experimenting with incorporating gen AI to help creators create different captions and thumbnails.

Meta Platforms has also started to roll out Reels in Meta AI chats. It is also exploring ways to make Facebook more attractive and fun-filled for users leveraging Meta AI.

Moreover, it is collaborating with industry partners on common technical standards for identifying AI content, including video and audio. The identification helps the company label AI-generated images that users post to Facebook, Instagram and Threads. This is expected to further improve user experience.

Meta Platforms’ commitment to prioritizing user safety and well-being through initiatives aimed at enhancing parental supervision, messaging privacy and time management on its platforms. These factors are expected to have driven user base growth in the first quarter of 2024.

Family Daily Active People or DAP, defined as a registered and logged-in user who visited at least one of the Family products (Facebook, Instagram, Messenger or WhatsApp) on a given day, is expected to be 3.21 billion. Family Monthly Active People or MAP is pegged at 4.03 billion.

What Do the Estimates Say?

The Zacks Consensus Estimate for first-quarter earnings is pegged at $4.32 per share, up 1.17% over the past 30 days and indicating 63.64% year-over-year growth.

It expects total revenues between $34.5 billion and $37 billion for the first quarter of 2024.

The consensus estimate for first-quarter revenues is currently pegged at $36.25 billion, indicating growth of 26.56% from the figure reported in the year-ago quarter.

Upcoming Earnings to Watch For

Meta Platforms belongs to the Zacks Internet Software industry. Investors are eagerly waiting for the upcoming earnings of Perfect Corp PERF and Pinterest PINS, two other top-ranked stocks in the same industry.

Both Perfect Corp and Pinterest sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

While Perfect is set to report its quarterly earnings on Apr 24, Pinterest is scheduled to report on Apr 30.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Perfect Corp. (PERF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance