Higher interest rates are boosting this life insurance, pensions and investment giant

Well, that is most frustrating. Our investment thesis on Legal & General is playing out nicely, if last week’s first-half results are anything to go by, but the share price is showing no interest at all.

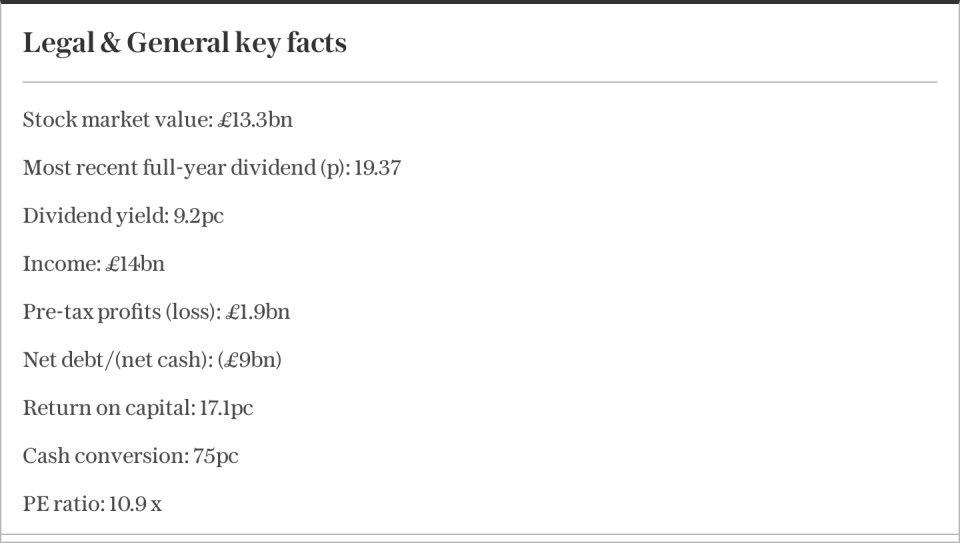

We shall simply have to sit tight and console ourselves with the knowledge that we are farming a 9pc dividend yield, a figure that even beats inflation and one that is backed by a robust balance sheet.

The interims show that the life insurance, pensions and investment giant is seeing the anticipated benefit from higher interest rates, namely the chance to grow its institutional pensions business (LGRI), as firms look to offload their pension risk through what is known as a bulk annuity agreement.

LGRI generates around 40pc of group first-half operating profit and looks well set, since management expects UK pension risk transfer (PRT) and annuity volumes to come in between £8bn and £12bn in 2023, compared to £8.3bn in 2022 and £7.2bn in 2021.

However, the market preferred to focus on the potential downside of higher interest rates, namely a 10pc, or £132bn, drop in assets under management.

Net outflows from Legal & General Investment Management (LGIM) were partly the result of market volatility but also net outflows as savers withdrew cash, either because they were dissatisfied fund performance, thanks to another turgid year from the UK stock market, or they needed the money to help them pay bills in the current inflationary environment.

LGIM contributed just 13pc of first-half divisional operating profits but investors took fright all the same, especially as investment losses meant that stated pre-tax profits fell sharply.

Thus, we must wait, and thankfully we can afford to do so. The valuation is attractive on an earnings basis, the yield is chunky, and management is sticking to its five-year plan of an annual growth rate in the pay-out of 5pc. Meanwhile, a first-half solvency ratio of 230pc more than meets regulatory capital requirements.

The shares will go ex-dividend on Thursday (August 24) and shareholders will receive their interim distribution of 5.71p per share on September 26.

Questor says: hold

Ticker: LGEN

Share price at close: 217.3p

Update: Just Group

Legal & General is getting the cold shoulder from investors and to compound our woes Just Group is getting the same treatment for the same reason, even if this company is again delivering on the promise identified in our initial study.

The forecast dividend yield is not as generous as it at Legal & General, at around 2.5pc, but the valuation is in some ways more compelling, given a single-digit forward price/earnings ratio and market capitalisation of £800m represents a hefty discount to net assets, or shareholders’ funds, of nearly £1.2bn.

Excluding intangible assets such as goodwill still leaves net asset value per share at 204p, way above the prevailing share price, and if profits advance in line with management targets than book value should continue to grow.

A specialist in individual annuities, bulk annuities and lifetime mortgages, Just Group is another potential beneficiary of rising interest rates, thanks to surging business flows in the bulk annuity business in particular.

Retirement income sales more than doubled in the first half. That sets a firm foundation for long-term future profit and cash flow, underpinning management’s target of trend annual earnings growth of 15pc, while in the near term underlying operating profit more than doubled and the dividend rose 15pc in the first half.

However, markets are preferring to focus on investment risk in the portfolio, especially bond and property exposure, thanks to the very same interest rate increases which are doing much to drive the business, even if Just Group actively hedges its exposure here.

Changes in interest rates cost the firm just £6m in the first six months of 2023, compared to £257m in the equivalent period of 2022, thanks to concerted efforts to reduce sensitivity to both interest rates and property valuations.

Again, therefore, we must sit and suffer.

The good news, if it can be called such, is that our lowly entry price means we are not sat on any paper losses, even after the recent share price swoon.

Valuation will hopefully provide us with one source of downside protection and the balance sheet another, given limited net borrowings and a Solvency II ratio of 204pc, up from 199pc at the end of 2022.

Questor says: hold

Ticker: JUST

Share price at close: 74.6p

Russ Mould is investment director at AJ Bell, the stockbroker

Read the latest Questor column on telegraph.co.uk every Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance