Highwoods Properties (HIW) Beats Q3 FFO & Revenue Estimates

Highwoods Properties Inc.’s HIW third-quarter funds from operations (FFO) per share of 88 cents surpassed the Zacks Consensus Estimate of 85 cents. The reported tally excluded the net impact of 5 cents relating to the company’s market rotation plan. The figure also improved 2.3% year over year.

Encouraging business conditions facilitated healthy leasing volume and robust rent spreads for the company. Highwoods also extended its near-term lease expirations by signing renewal agreements.

Particularly, rental and other revenues of approximately $187.5 million in the quarter outpaced the Zacks Consensus Estimate of $185.9 million. Further, the reported figure compares favorably with the year-earlier quarter’s $179.4 million.

Quarter in Detail

Highwoods leased 939,000 square feet of second-generation office space during the third quarter. Rents were up 19.4% on a GAAP basis and 5.6% on a cash basis.

The company also signed a long-term renewal for largest remaining lease expiration in 2021. Highwoods achieved a weighted average lease term of 6.7 years. This is 14% longer than the prior five-quarter average.

Same-property cash net operating income (NOI) inched up 0.5% year over year and 1.9% excluding the effect from Laser Spine’s sudden closure. The company ended the July-September quarter with occupancy of 91.4%.

At the end of the quarter, Highwoods’ development pipeline totaled $500 million and was 73% pre-leased on a dollar-weighted basis. The company placed in service 5000 CentreGreen, a 170,000-square-foot office building in Cary’s Weston submarket during the reported period. The property was 100% leased.

As of Sep 30, 2019, Highwoods had around $116.7 million of cash and cash-equivalents compared with around $3.8 million reported as of Dec 31, 2018.

The company exited the September-end quarter with a net debt-to-EBITDAre ratio of 4.92x. This included the net impact relating primarily to Highwoods’ market rotation plan. It did not issue any shares under the ATM program.

2019 Outlook

Highwoods has revised its 2019 FFO per share guidance to reflect the net impact of the company’s market rotation plan. Accordingly, the company now anticipates full-year 2019 FFO per share in the range of $3.31 to $3.33 as compared with the $3.32-$3.38 issued earlier. The Zacks Consensus Estimate for the same is currently pinned at $3.32.

Further, for the ongoing year, dispositions and acquisitions are anticipated in the $37-$473 million band and up to $436 million, respectively.

Our Viewpoint

During the third quarter, Highwoods made strategic moves to fortify its best-business district (BBD) office focus. The company has planned to exit the Greensboro and Memphis markets. In addition, it aims to enter the Charlotte market through the acquisition of Bank of America Tower at Legacy Union for total investments of $436 million. The transaction is scheduled to close on Nov 14, 2019.

Additionally, subsequent to the third-quarter end, the company inked a long-term renewal and expansion lease, extending the second largest remaining 2021 lease expiration.

Such efforts will strengthen the company’s portfolio and stoke long-term growth.

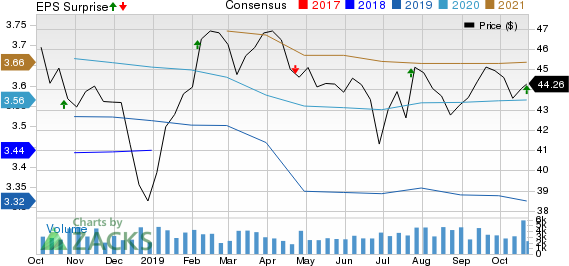

Highwoods Properties, Inc. Price, Consensus and EPS Surprise

Highwoods Properties, Inc. price-consensus-eps-surprise-chart | Highwoods Properties, Inc. Quote

Highwoods currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of other REITs like Alexandria Real Estate Equities ARE, Vornado Realty Trust VNO and Welltower Inc. WELL.

All three companies are scheduled to release their quarterly numbers on Oct 28.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vornado Realty Trust (VNO) : Free Stock Analysis Report

Highwoods Properties, Inc. (HIW) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance