Should You Hold Sempra Energy Stock in Your Portfolio Now?

We issued an updated research report on Sempra Energy SRE on Sep 11. This electricity and natural gas provider enjoys a significant position in the Utilities sector, given its stable earnings from subsidiaries.

Going ahead, the company expects to witness a long-term CAGR of 10-11% in its earnings per share (EPS) in the 2017-2021 time frame, almost double the CAGR of 5-6% anticipated for the S&P 500 Utilities on average.

Realizing the demand and prospects of renewable energy, Sempra Energy has already started to add solar, wind and hydro assets to its portfolio. Toward this end, in July 2017, the company acquired solar projects capable of producing up to 200 MW of solar power in Fresno County, California. Commercial operation and corresponding contracted energy sales from these projects are expected to commence in phases beginning the fourth quarter of 2017 and the first half of 2018.

In terms of financial stability, the company boasts strong cash balance reserve, which in turn helps it to maintain solid cash deployment strategies. Currently, Sempra Energy continues to keep its annual dividend increase target at 8% to 9% over the next few years. Its efforts on maximizing shareholders value through regular dividend payments will retain investors’ interest in the stock.

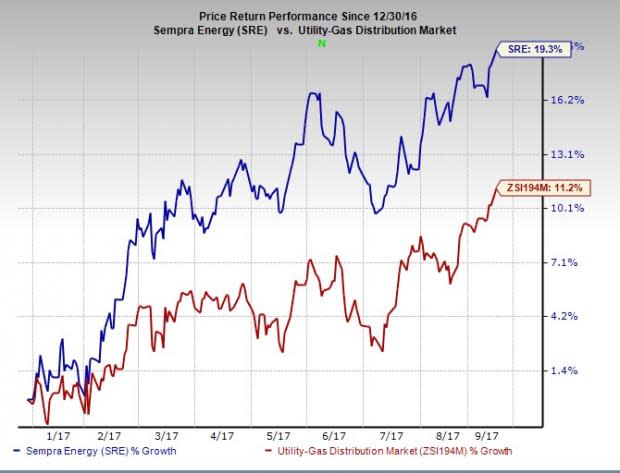

Notably, strong capital deployment strategies may have led the company to outperform its broader industry. Evidently, Sempra Energy’s share price has gained 19.3% on a year-to-date basis, higher than the broader industry’s 11.2% gain.

On the flip side, Sempra Energy has been suffering, with the nuclear industry facing difficult times, given the availability of low-priced natural gas and the government-subsidized wind sector. Meanwhile, the permanent shutdown of Units 2 and 3 of the company’s San Onofre Nuclear Generating Stations (SONGS) in California is likely to worsen the situation. Moreover, the company continues to incur considerable expenses in relation to the Aliso Canyon gas leak, which in turn may bring down its operating profit.

The company also faces tough competition from its peers like Just Energy Group, Inc. JE, NewJersey Resources Corporation NJR and Clean Energy Fuels Corporation CLNE.

Zacks Rank

Sempra Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sempra Energy (SRE) : Free Stock Analysis Report

Clean Energy Fuels Corp. (CLNE) : Free Stock Analysis Report

NewJersey Resources Corporation (NJR) : Free Stock Analysis Report

Just Energy Group, Inc. (JE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance