A Holistic Look At Take-Two Interactive Software Inc (NASDAQ:TTWO)

As an investor, I look for investments which does not compromise one fundamental factor for another. By this I mean, I look at stocks holistically, from their financial health to their future outlook. In the case of Take-Two Interactive Software Inc (NASDAQ:TTWO), it is a company with impressive financial health as well as an optimistic growth outlook. In the following section, I expand a bit more on these key aspects. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Take-Two Interactive Software here.

Flawless balance sheet with reasonable growth potential

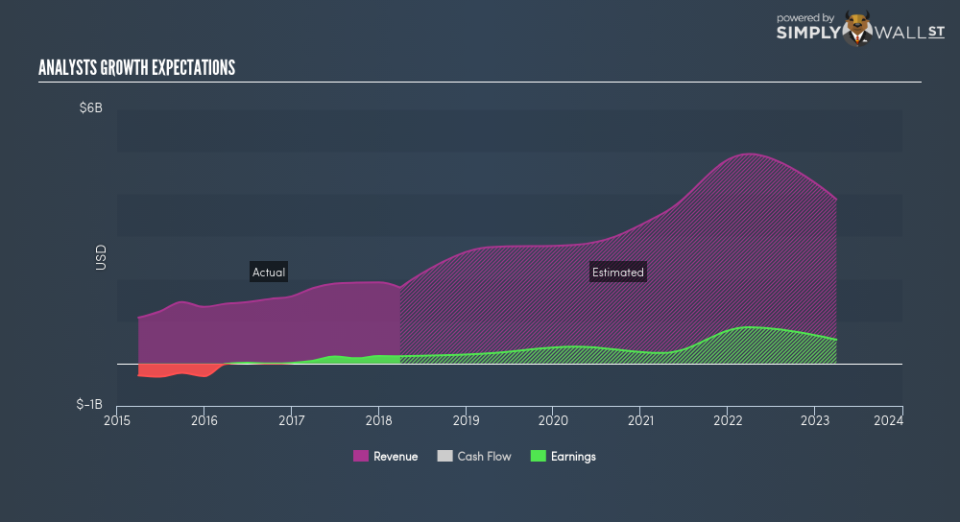

TTWO’s outstanding revenue growth of 56.22% forecasted for the near future is certainly eye-catching for investors on the hunt for growth, bolstered by its impressive cash-generating ability, as analysts predict its operating cash flows will rise by 80.60% over the same time period. This suggests that TTWO’s revenue is made up of high-quality cash from TTWO’s day-to-day business as opposed to one-off income. TTWO’s strong financial health means that all of its upcoming liability payments are able to be met by its current cash and short-term investment holdings. This indicates that TTWO has sufficient cash flows and proper cash management in place, which is an important determinant of the company’s health. TTWO seems to have put its debt to good use, generating operating cash levels of 48.83x total debt in the most recent year. This is also a good indication as to whether debt is properly covered by the company’s cash flows.

Next Steps:

For Take-Two Interactive Software, there are three pertinent aspects you should further research:

Historical Performance: What has TTWO’s returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

Valuation: What is TTWO worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether TTWO is currently mispriced by the market.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of TTWO? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance