Home Depot vs. Lowe's: What's the Better Buy?

Home Depot HD and Lowe’s LOW undoubtedly jump to the forefront of many minds when thinking of heavyweights within retail building products.

After all, they’re both titans in their industry, carrying a fully-established nature through decades of operations.

Still, with companies having similar operations, it raises a valid question: which stock looks like a better buy? Let’s take a closer look.

Share Performance

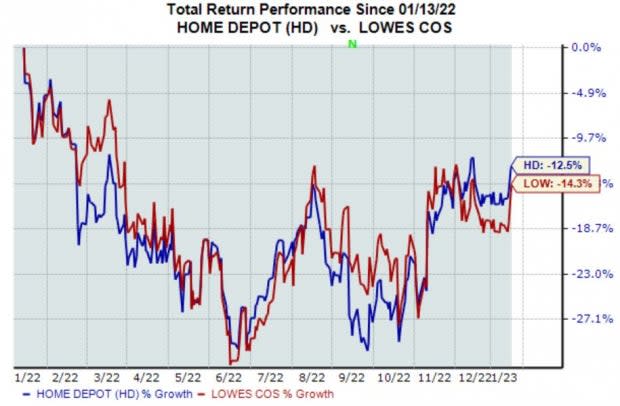

By looking at each stock’s performance over various timeframes, we can spot which carries more positive momentum and where the buyers have been.

Over the last year, Home Depot shares have marginally outperformed, declining roughly 12% vs. LOW’s 14% decline.

Image Source: Zacks Investment Research

And over the last three months, the story has remained the same; HD has outperformed LOW, with its shares gaining more than 17%.

Image Source: Zacks Investment Research

As we can see, buyers have preferred Home Depot shares over the recent term.

Valuation

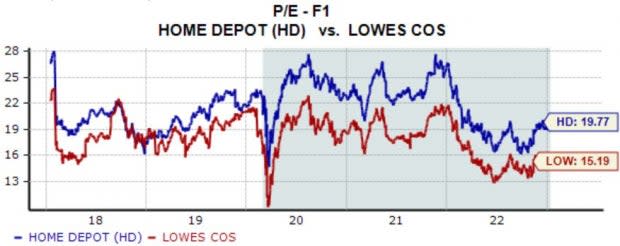

Of course, valuation is a massive aspect that investors consider when making decisions.

Currently, Home Depot’s forward earnings multiple of 19.8X is well above LOW’s 15.2X. Still, it’s worth mentioning that both companies’ values trade at a discount to their respective five-year medians.

In addition, HD carries a Value Style Score of “C,” whereas LOW sports a “B.”

Image Source: Zacks Investment Research

In this round, Lowe’s comes out on top.

Dividends

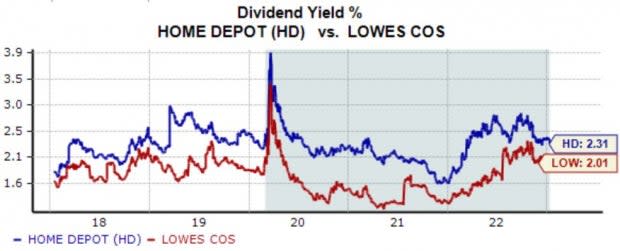

Who doesn’t love dividends? Dividends help alleviate the impact of drawdowns in other positions, provide flexibility and a passive income stream.

Home Depot rewards its shareholders via its annual dividend that currently yields 2.3%, modestly above LOW’s 2%.

Image Source: Zacks Investment Research

However, Lowe’s has been more committed to increasingly rewarding its shareholders, carrying a 20% five-year annualized dividend growth rate vs. Home Depot’s 16%.

In this round, it appears that HD just slightly edges out LOW.

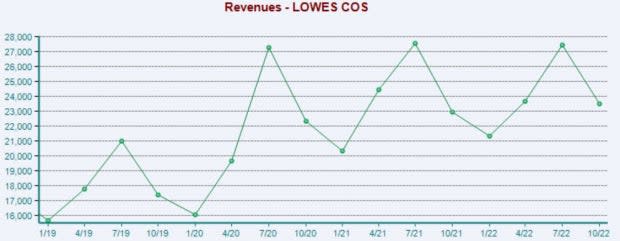

Quarterly Performance

Home Depot has consistently posted better-than-expected quarterly results, exceeding top and bottom line estimates in ten consecutive quarters.

In its latest release, the company beat revenue expectations by 2.5% and reported earnings 3% above estimates.

Image Source: Zacks Investment Research

On the flip side, Lowe’s has also consistently exceeded EPS estimates, penciling in 14 consecutive earnings beats.

However, revenue results have been mixed as of late, with LOW falling short of sales expectations in two of its last four quarters.

Image Source: Zacks Investment Research

Home Depot has put in a better quarterly performance, consistently exceeding both top and bottom line estimates.

Bottom Line

It certainly isn’t easy to choose between these two heavyweights, as they’ve both established dominant stances within the market.

Still, a winner has got to come out on top, and it appears that it’s Home Depot HD. Here’s why –

HD shares have been stronger, the company’s annual dividend is nicely above that of Lowe’s, and the company has put in a more consistent quarterly performance.

However, Lowe’s LOW could be enticing for more value-conscious investors, with the company carrying a lower forward earnings multiple.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance