Homebuilding Market Witnessing a Rebound in 2024: 5 Top Picks

The homebuilding industry has been gradually recovering over the last five months after a two-year slump. This space bore the brunt of the Federal Reserve’s aggressive interest rate hike policy.

Accelerating mortgage rates, as well as rising raw material and labor costs, hit the homebuilding industry. Buyers were discouraged from investing in new homes despite strong demand.

With a decline in the inflation rate, the central bank stopped hiking the benchmark lending rate in July 2023. Moreover, in its March FOMC meeting, the Fed gave an indication of three rate cuts of 25 basis points each in 2024.

Positive Catalysts

Hopes of a lower risk-free market interest rate have resulted in a decline in mortgage rates since November 2023. A low mortgage rate will be extremely beneficial for both home buyers and sellers.

The National Association of Homebuilders/Wells Fargo Index reading showed that homebuilder confidence increased to 51 in March from 48 in February. Notably, the index has shown a secular uptrend in the last five months. March’s reading was the highest since July 2023.

According to Commerce Department data released on Mar 19, housing starts jumped 10.7% month over month to a seasonally adjusted annual rate of 1.521 million units in February, beating the consensus estimate of 1.453 million units by 4.7%. Also, the February figure rose 5.9% on a year-over-year basis. The January figure was also revised upward to 1.374 million units from 1.331 million units reported previously.

Adding to the positives, residential building permits — an indicator of construction activity — climbed 1.9% month over month and 2.4% year over year in February to an annualized rate of 1.518 million units. The February permit level surpassed analysts’ prediction of 1.490 million units by 1.9%. The January figure was also revised upward to 1.489 million units from 1.470 million units reported previously.

There is a sizable shortage of new homes after more than a decade of under-building compared with population growth. Continued demand for homes despite high mortgage interest rates amid low supply has been generating profit for homebuilders.

Effective Cost Control Measures

Given the accelerated raw material prices, companies have been relying on effective cost control and focusing on making the homebuilding platform more efficient, which, in turn, is resulting in higher operating leverage.

Homebuilders have been controlling construction costs by designing homes efficiently and obtaining construction materials and labor at competitive prices. Some homebuilders also follow a dynamic pricing model, which enables them to set the price according to the latest market conditions.

The majority of companies are focused on the growing demand for entry-level homes and addressing the need for lower-priced homes, given affordability concerns in the U.S. housing market. Meanwhile, industry players have been acquiring other homebuilding companies in desirable markets, resulting in improved volumes, market share, revenues and profitability.

Our Top Picks

We have narrowed our search to five homebuilders with strong potential for 2024. These stocks have seen positive earnings estimate revisions in the past 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

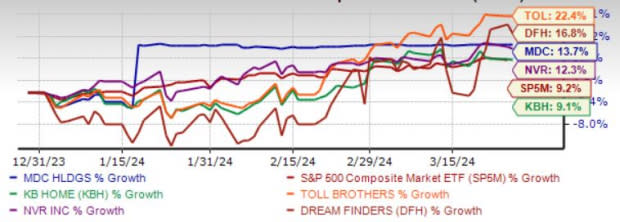

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Toll Brothers Inc. TOL is gaining from strong market demand, combined with its policy of boosting its supply of spec homes and focusing on operational efficiency. Also, TOL’s emphasis on affordable luxury communities and its build-to-order model bodes well.

Since mid-January, TOL has experienced a notable surge in demand coinciding with the onset of the spring selling season. Considering the upward market trend, TOL expects home deliveries of 10,000-10,500 units in fiscal 2024, which implies growth from 9,597 units in fiscal 2023.

Zacks Rank #1 Toll Brothers has an expected revenue and earnings growth rate of 0.7% and 11.1%, respectively, for the current year (ending October 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the past seven days.

NVR Inc. NVR has been benefiting from the low supply of existing homes and decreased ASP of new orders, which have sparked new order growth and reduced cancellation rates, increasing the growth prospects of the company. On a unit basis, backlog at 2023 end improved 12% year over year to 10,229 homes and grew 10% on a dollar basis to $4.76 billion.

Unlike other homebuilders, NVR’s sole business is selling and building quality homes by typically acquiring finished building lots without the risk of owning and developing land in a cyclical industry.

Zacks Rank #1 NVR has an expected revenue and earnings growth rate of 7.7% and 4.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 16.6% over the past 30 days.

Dream Finders Homes Inc. DFH operates as a holding company for Dream Finders Homes LLC, which is engaged in the homebuilding business in the United States. DFH operates through four segments: Southeast, Mid-Atlantic, Midwest, and Financial Services.

DFH designs, constructs, and sells single-family entry-level, first-time and second-time move-up homes, as well as active adult homes and custom homes. DFH markets its homes under various brands, including Dream Finders Homes, DF Luxury, Craft Homes, and Coventry Homes.

Zacks Rank #1 Dream Finders Homes has an expected revenue and earnings growth rate of 15.7% and 12.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.7% over the past 30 days.

KB Home KBH is benefiting from its focus on implementing the built-to-order model, reducing cycle times and improving demand trends. KBH offers various forms of mortgage concessions that bode well for its home order growth. For fiscal 2024, KBH expects housing revenues between $6.40 and $6.80 billion, up from the fiscal 2023 level of $6.37 billion.

Zacks Rank #2 KB Home has an expected revenue and earnings growth rate of 4.8% and 10.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.6% over the past seven days.

M.D.C. Holdings Inc. MDC has been reaping benefits from the successful execution of strategic initiatives to boost profitability, with a focus on entry-level homes. MDC’s focus on a more spec-driven operating model, given an uncertain economy, helps cater to the needs of first-time homebuyers.

Moreover, MDC is offering great opportunities for build-to-order buyers, such as long-term interest rate lock programs and other special incentives. MDC’s land acquisition strategies and high liquidity add to its growth.

Zacks Rank #2 M.D.C. Holdings has an expected revenue and earnings growth rate of 7.1% and 1.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.1% over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

M.D.C. Holdings, Inc. (MDC) : Free Stock Analysis Report

Dream Finders Homes, Inc. (DFH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance