New Home's (NYSE:NWHM) Wonderful 385% Share Price Increase Shows How Capitalism Can Build Wealth

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. While not every stock performs well, when investors win, they can win big. For example, The New Home Company Inc. (NYSE:NWHM) has generated a beautiful 385% return in just a single year. It's also good to see the share price up 19% over the last quarter. But this could be related to the strong market, which is up 8.2% in the last three months. Zooming out, the stock is actually down 50% in the last three years.

View our latest analysis for New Home

Because New Home made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last year New Home saw its revenue shrink by 24%. This is in stark contrast to the splendorous stock price, which has rocketed 385% since this time a year ago. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. While this gain looks like speculative buying to us, sometimes speculation pays off.

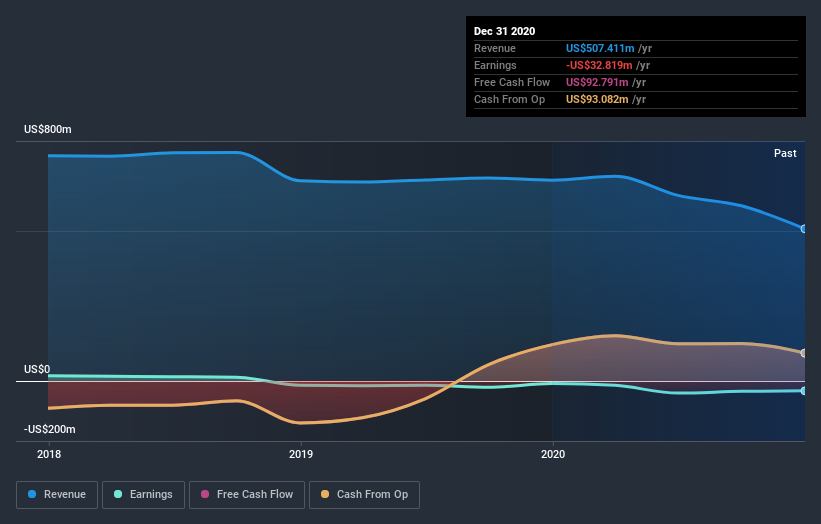

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that New Home shareholders have received a total shareholder return of 385% over one year. Notably the five-year annualised TSR loss of 9% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for New Home you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance