Honeywell (HON) Inks $1.3B Deal to Settle Asbestos Claims

Honeywell International HON has entered into a definitive agreement with the North American Refractories Asbestos Personal Injury Settlement Trust to settle claims over its manufacture of products containing asbestos in the past, per an SEC filing.

Subject to the terms of the agreement, Honeywell will make a one-time payment of $1.325 billion to the trust to release itself from further funding obligations to the latter. Once the deal is complete, HON will have “limited obligations” to the trust.

Honeywell had purchased North American Refractories Company (“NARCO”), an asbestos refractory materials manufacturer, in 1979. Given the carcinogenic impact of asbestos exposure, HON found itself embroiled in several asbestos-related lawsuits, thanks to its subsidiary’s operations. The NARCO unit filed for bankruptcy and established a trust fund of $6.32 billion in 2013 to settle asbestos claims.

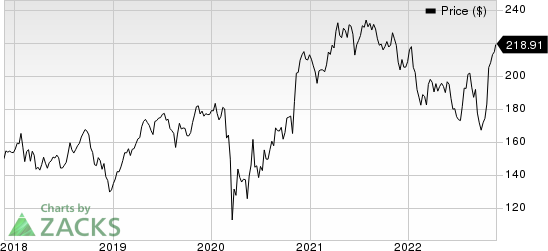

Honeywell International Inc. Price

Honeywell International Inc. price | Honeywell International Inc. Quote

Honeywell’s deal with the trust is subject to a final order from the US Bankruptcy Court. HON said that NARCO’s reserve of $695 million would be removed from its balance sheet and a charge will be recognized once the deal is approved.

Honeywell has reaffirmed fourth-quarter 2022 and full-year guidance as it does not expect the accounting impacts of the agreement to affect its financial statements in the ongoing year.

Zacks Rank & Key Picks

Honeywell carries a Zacks Rank #3 (Hold). Some better-ranked stocks are as follows:

Enerpac Tool Group Corp. EPAC delivered an average four-quarter earnings surprise of 3.4%. EPAC presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks.

Enerpac Tool’s estimated earnings growth rate for the current fiscal year is 44.6%. Shares of EPAC have jumped 23.7% in the past six months.

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy). AIT delivered a trailing four-quarter earnings surprise of 24.8%, on average.

Applied Industrial has an estimated earnings growth rate of 14.3% for the current fiscal year. The stock has gained 31.7% in the past six months.

Parker-Hannifin Corporation PH currently carries a Zacks Rank of 2. PH pulled off a trailing four-quarter earnings surprise of 11.3%, on average.

Parker-Hannifin has an estimated earnings growth rate of 2.2% for the current fiscal year. Shares of PH have rallied 16.7% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

ParkerHannifin Corporation (PH) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Enerpac Tool Group Corp. (EPAC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance