Honeywell (HON) Q3 Earnings Surpass Estimates, Revenues Miss

Honeywell International Inc. HON has reported mixed third-quarter 2021 results, wherein earnings surpassed estimates but revenues lagged the same.

Earnings & Revenues

Adjusted earnings were $2.02 per share, surpassing the Zacks Consensus Estimate of $2.01. The bottom line soared 29.5% year over year.

Honeywell’s third-quarter revenues were $8,473 million, missing the consensus estimate of $8,708 million. The top line increased 9% year over year on a reported basis and 8% on an organic basis. The rise was driven by strength in warehouse and workflow solutions, productivity solutions and services, and gas analysis businesses along with strong demand for building products as well as process solutions services and thermal solutions. It was also supported by a recovery in commercial aftermarket demand and solid growth in business and general aviation original equipment demand.

Segmental Breakup

Coming to operating segments, Aerospace’s quarterly revenues were $2,732 million, up 3% year over year. Honeywell Building Technologies’ revenues increased 5% to $1,370 million. Performance Materials and Technologies’ revenues totaled $2,510 million, up 11% while that for Safety and Productivity Solutions increased 18% to $1,861 million.

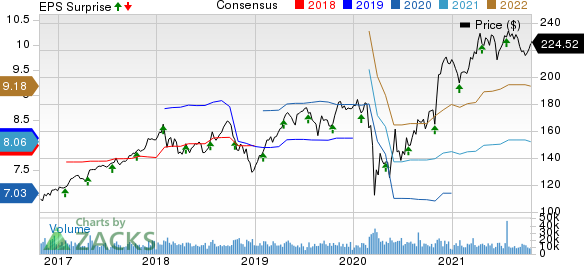

Honeywell International Inc. Price, Consensus and EPS Surprise

Honeywell International Inc. price-consensus-eps-surprise-chart | Honeywell International Inc. Quote

Costs/Margins

The company’s total cost of sales in the reported quarter was $5,746 million, up 6.7% year over year. Selling, general and administrative expenses were $1,152 million, up 4.4%. Interest expenses and other financial charges were $90 million compared with $101 million a year ago.

Operating income in the third quarter was $1,575 million, up 20.1% on a year-over-year basis. Operating income margin was 18.6%, up 180 basis points.

Balance Sheet/Cash Flow

Exiting the third quarter, Honeywell had cash and cash equivalents of $11,087 million compared with $11,427 million in the previous quarter. Long-term debt was $14,346 million, lower than $16,138 million recorded at the end of the previous quarter.

In the first nine months of 2021, the company generated $3,375 million in cash from operating activities compared with $3,426 million in the year-ago period. In the first nine months of 2021, capital expenditure was $614 million compared with $615 million incurred a year ago.

Free cash flow in the quarter was $911 million, up 20% year over year.

Outlook

Honeywell updated guidance for full-year 2021. For the year, the company anticipates earnings to be in the range of $8.00 to $8.10 per share compared with $7.95 to $8.10 guided earlier. It anticipates revenues to be between $34.2 billion and $34.6 billion, with organic revenues expected to be up 4-5%. It previously anticipated revenues to lie in the range of $34.6 billion to $35.2 billion.

For 2021, it expects operating cash flow in the range of $5.9 billion to $6.2 billion, and free cash flow to be between $5.3 billion and $5.6 billion.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the same space are Raven Industries, Inc. RAVN, Griffon Corporation GFF, and Danaher Corporation DHR. While Raven currently sports a Zacks Rank #1 (Strong Buy), Griffon and Danaher carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Raven delivered an earnings surprise of 42.59%, on average, in the trailing four quarters.

Griffon delivered an earnings surprise of 26.02%, on average, in the trailing four quarters.

Danaher delivered an earnings surprise of 25.29%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Honeywell International Inc. (HON) : Free Stock Analysis Report

Danaher Corporation (DHR) : Free Stock Analysis Report

Raven Industries, Inc. (RAVN) : Free Stock Analysis Report

Griffon Corporation (GFF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance