Investors pull $5bn from Hong Kong as protests continue

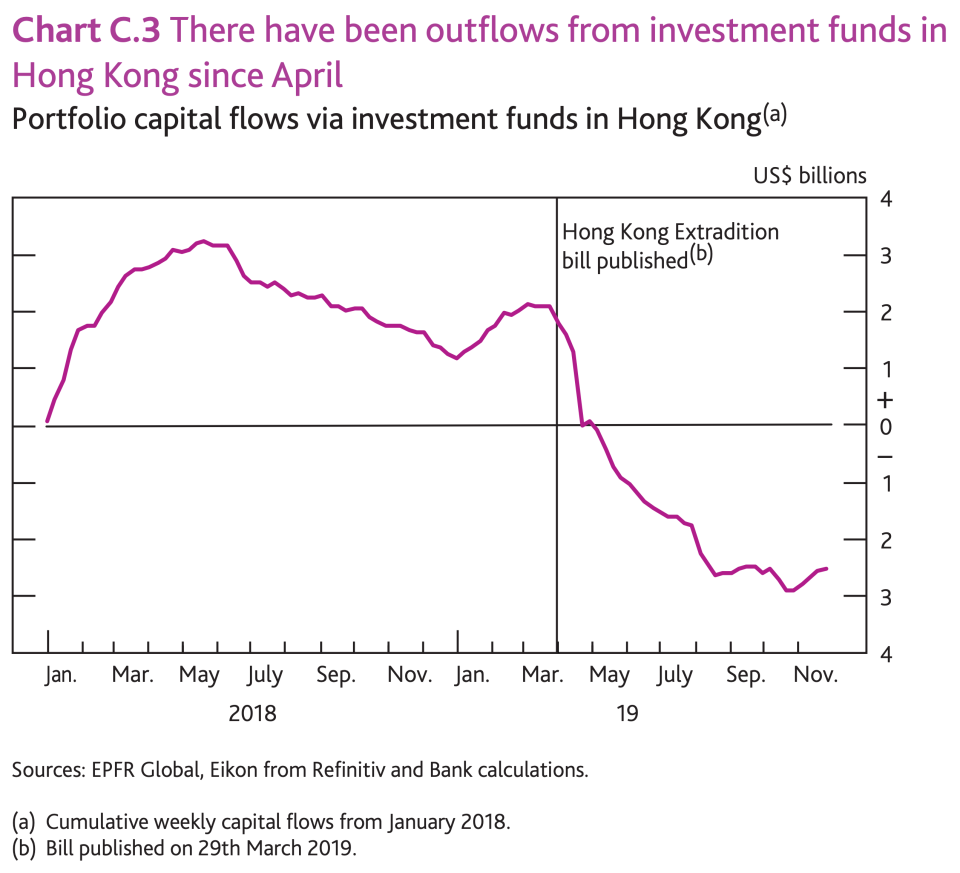

Investors have pulled $5bn (£3.77bn) from Hong Kong since pro-democracy protests began in April, highlighting the economic toll taken on the Asian financial hub.

The Bank of England said in its Financial Stability Report, published on Monday, that cumulative outflows from investment funds in Hong Kong have reached around $5bn since unrest began. The outflows are equivalent to about 1.25% of the country’s GDP.

“The protests, and their impact on the real economy, highlight political risk as a key vulnerability in Hong Kong,” the Bank of England wrote in its report. “And these political tensions pose risks, given Hong Kong’s position as a major financial centre.”

Widespread protests erupted in Hong Kong in April after the autonomous region’s government tried to introduce a bill that would allow people to be extradited to mainland China.

The bill was officially abandoned in September but pro-democracy protests have continued, with increasingly violent clashes between demonstrators and police. Hong Kong police warned last month that rule of law is on the “brink of total collapse.”

READ MORE: Bank of England: UK banks resilient despite 'global vulnerabilities'

The unrest has tipped Hong Kong into recession and led to the weakest quarterly GDP reading since 2009. Hong Kong’s Hang Seng index (^HSI) has also declined by 12% since April and commercial property sales have declined by a third, the Bank of England said.

UK banks have “significant” exposure to Hong Kong, the central bank said. HSBC (HSBA.L) has its roots in the area and Standard Chartered (STAN.L) also has a significant presence there.

The Bank of England factored in the unrest in Hong Kong into its annual ‘stress testing’ of banks. All seven major UK lenders passed and the Bank of England said its modelling was sufficiently tough to withstand even a sharp deterioration of conditions in Hong Kong.

“Recent developments in Hong Kong are also encompassed within that stress scenario,” the central bank said. ”It incorporated a fall of almost 8% in Hong Kong GDP and falls in property prices of more than 50%.”

READ MORE: New fund rules could see investors take 'haircut' after Woodford crisis

Yahoo Finance

Yahoo Finance