New Hope Corp Ltd's Dividend Analysis

Insights into New Hope Corp Ltd's Upcoming Dividend Payment

New Hope Corp Ltd (NHPEF) recently announced a dividend of $0.17 per share, payable on 2024-05-01, with the ex-dividend date set for 2024-04-15. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into New Hope Corp Ltd's dividend performance and assess its sustainability.

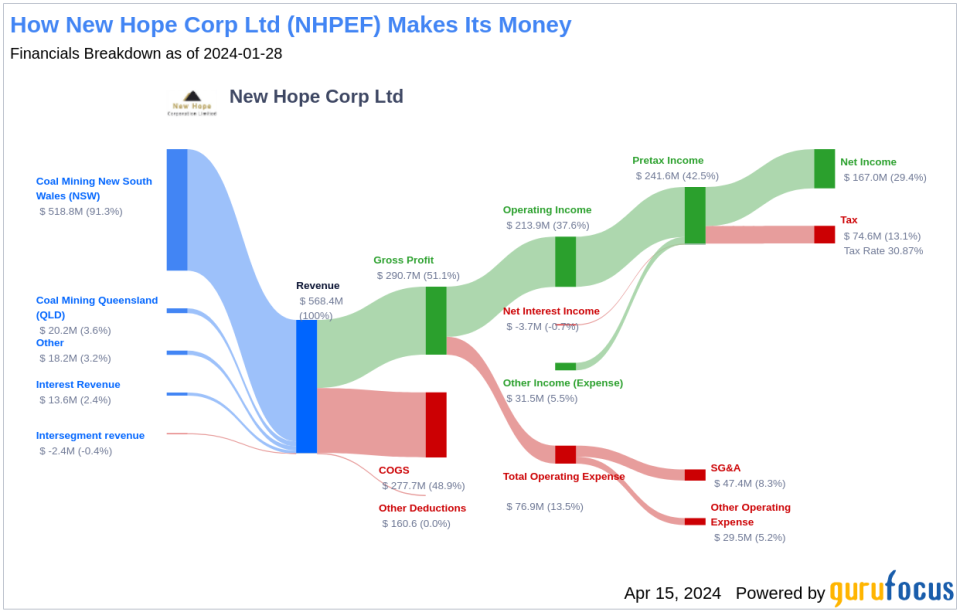

What Does New Hope Corp Ltd Do?

Warning! GuruFocus has detected 13 Warning Signs with SBFFF.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

New Hope Corp Ltd is an Australian thermal coal miner with significant operations and assets. The company boasts two main mining operations: the wholly-owned New Acland coal mine in Queensland and the 80%-owned Bengalla coal mine in New South Wales. New Hope Corp Ltd is on track to substantially increase its annual production of salable thermal coal, aiming to reach around 13 million metric tons by fiscal 2028, a considerable jump from the 7.5 million metric tons expected in fiscal 2023. The company's coal production primarily serves the seaborne thermal coal export markets, with reserves at New Acland and Bengalla supporting operations for many decades. Additionally, New Hope Corp Ltd holds undeveloped coal resources in Queensland and a 20% stake in the Malabar-Maxwell metallurgical coal mine, which commenced production in 2023.

A Glimpse at New Hope Corp Ltd's Dividend History

New Hope Corp Ltd has established a reliable track record of dividend payments since 2021, distributing dividends bi-annually. This consistent payout is a crucial factor for income-focused investors. Below is a chart showing the annual Dividends Per Share for tracking historical trends.

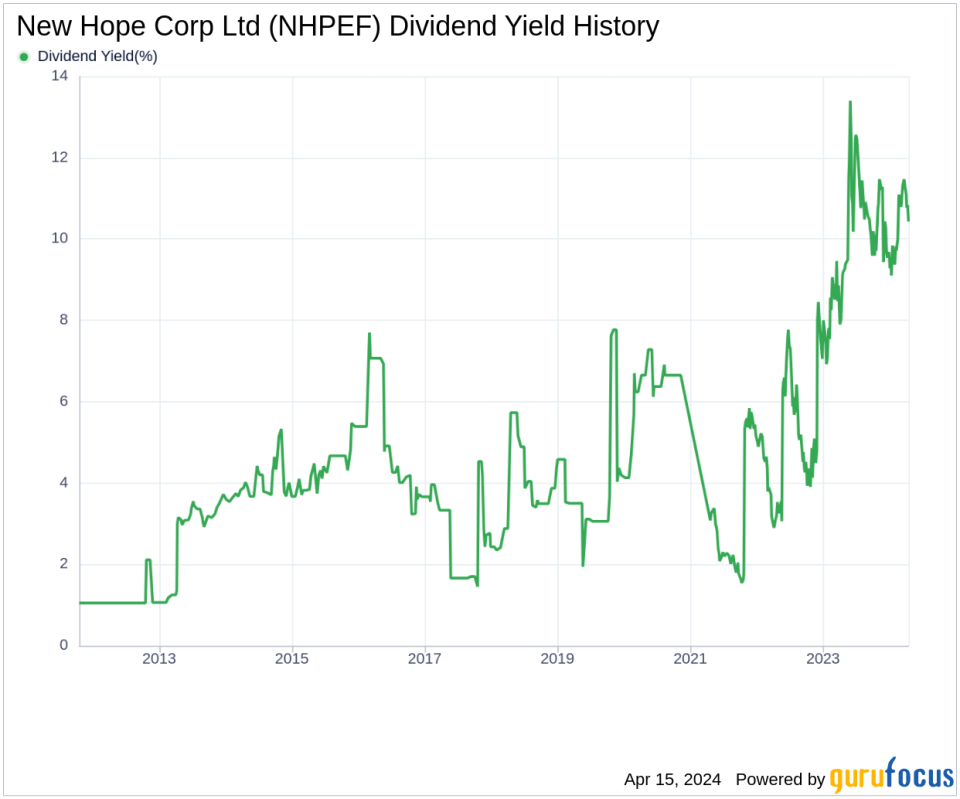

Breaking Down New Hope Corp Ltd's Dividend Yield and Growth

As of today, New Hope Corp Ltd's 12-month trailing dividend yield stands at 10.51%, with a 12-month forward dividend yield of 6.97%, indicating a projected decrease in dividend payments over the next year. Over the past three years, New Hope Corp Ltd's annual dividend growth rate was 59.60%, which slowed to 25.80% per year when extended to a five-year period. However, over the past decade, the company's annual dividends per share growth rate has been an impressive 11.90%.

Considering New Hope Corp Ltd's dividend yield and five-year growth rate, the 5-year yield on cost for the stock is approximately 33.11% as of today.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of New Hope Corp Ltd's dividend is often gauged by its dividend payout ratio, which currently stands at 0.66 as of 2024-01-31. This figure represents the portion of earnings paid out as dividends and suggests the company is managing its financial resources prudently. Additionally, the profitability rank of 6 out of 10 indicates fair profitability, with New Hope Corp Ltd recording net profit in 7 of the past 10 years.

Growth Metrics: The Future Outlook

For dividends to be sustainable in the long term, New Hope Corp Ltd needs to demonstrate strong growth metrics. The company's growth rank of 6 out of 10 suggests a fair growth outlook. When we look at New Hope Corp Ltd's revenue per share and the 3-year revenue growth rate, we see a robust revenue model with an average annual increase of approximately 31.70%, outperforming about 66.94% of global competitors.

Concluding Thoughts on New Hope Corp Ltd's Dividend Profile

In conclusion, New Hope Corp Ltd's upcoming dividend payment, along with its history of dividend growth and reasonable payout ratio, paints a picture of a company committed to providing shareholder value. The balance between profitability and growth metrics suggests that New Hope Corp Ltd is positioned to maintain its dividend payments while also investing in future expansion. As value investors consider the potential of New Hope Corp Ltd as part of their investment portfolio, they can also leverage tools like the High Dividend Yield Screener available to GuruFocus Premium users to discover other high-dividend yield opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance