Horace Mann (HMN) Q2 Earnings Beat Estimates, Increase Y/Y

Horace Mann Educators Corporation HMN delivered second-quarter 2021 adjusted earnings of $1.02 per share, beating the Zacks Consensus Estimate by 3%. The bottom line also improved 52.2% year over year.

The company gained from a healthy revenue stream, improved net income and core earnings. Its Supplemental, Life and Health segments also contributed to this upside.

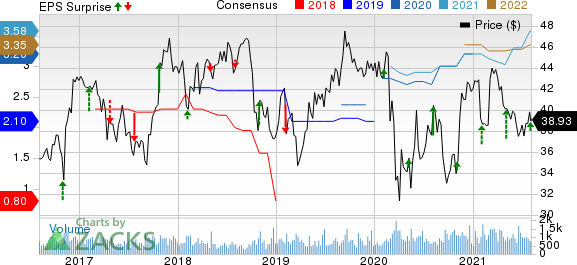

Horace Mann Educators Corporation Price, Consensus and EPS Surprise

Horace Mann Educators Corporation price-consensus-eps-surprise-chart | Horace Mann Educators Corporation Quote

Quarterly Operational Update

Total revenues of $347 million rose 10.2% year over year on higher net investment income.

Net income soared 53.1% year over year in the second quarter of 2021.

Net investment income of the company rose 36% year over year on the back of solid returns from the alternatives portfolio.

Core earnings of the company surged 52.9% year over year in the second quarter.

Operating expenses of the company increased 8.6% year over year due to higher benefits, claims and settlement costs, operating expenses, etc.

Quarterly Segment Update

Property and Casualty’s written premiums declined 0.3% year over year to $155.6 million. This was due to the low new business volume as a result of the pandemic.

Net investment income from this segment jumped 244.4% year over year.

Core earnings from the segment were up 70.8% year over year on the back of higher net investment income.

Combined ratio expanded 380 basis points (bps) year over year to 99.2%.

Supplemental segment’s sales were $1.2 million in the quarter, up 71.4%. However, the same was partly offset by limited school access because of the COVID-19 pandemic.

Written premiums from the segment slipped 5.9% year over year to $31.7 million. Core earnings ascended 26.3% year over year.

Retirement Segment’s annuity contract deposits climbed 15.6% year over year.

Core earnings from the business rose 18.6% year over year.

This segment witnessed net investment income of $36.9 million in the quarter under review, up 18.3% year over year.

Life Segment's sales were unchanged from the year-ago quarter. This was mainly owing to solid new sales of recurring premium policies and a hike in sales of the single premium policies. Core earnings from this segment skyrocketed 163.2% year over year.

Written premiums from the business rose 6.9% from the year-ago period.

Financial Position (as of Jun 30 2021)

Total assets were $14.1 billion, up 12.9% year over year.

The company exited the second quarter with shareholders’ equity of $1.8 billion.

The company had total debt of $413.5 million, down 5.4% year over year.

2021 Outlook

The company reaffirmed its full-year earnings per share view in the band of $3.50-$3.70. Core ROE is estimated to be more than 10%.

Zacks Rank

Horace Mann Educators has a Zacks Rank #2 (Buy), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among the other insurance industry players, which have reported second-quarter earnings so far, the bottom-line results of The Progressive Corporation PGR, RLI Corp. RLI and The Travelers Companies, Inc. TRV beat the respective Zacks Consensus Estimate.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Horace Mann Educators Corporation (HMN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance