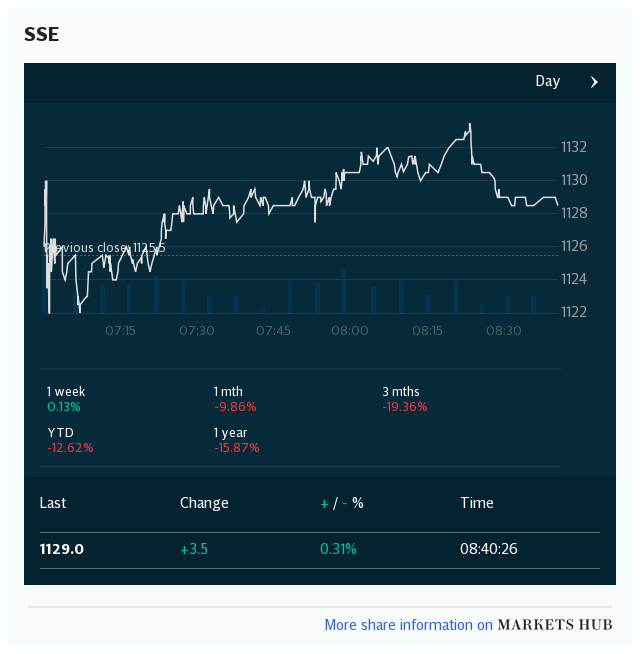

SSE weathers £80m hit as shareholders flip the switch on Npower deal

Big six energy giant SSE has blamed Britain's calm and balmy weather for an £80m hit to its profits as it prepares to siphon off its household supply arm to avoid the Government's cap on prices.

SSE's shareholders voted through plans to back out of the household energy market at the company's annual meeting on Thursday afternoon, just hours after MPs backed new legislation to set energy tariff caps.

Under the new law the regulator will be able to set a cap on energy tariffs from the end of 2018 until the end of 2020 before deciding whether to keep a lid on prices until 2023.

The first price intervention in the market since privatisation looms over the industry as costs creep steadily higher and competition ratchets up with each new entrant to the market.

SSE said its profits are likely to fall £80m short of expectations because the soaring temperatures in recent months hindered sales of household gas, while lower wind speeds cut the amount of electricity generated by SSE's fleet of wind power projects.

SSE sold around 10pc less gas than expected as customers in the first quarter of this financial year as temperatures held 1.5 degrees higher than the 30-year average. Meanwhile, “poorer than average wind conditions” meant its onshore and offshore wind farms generated around 15pc less electricity than anticipated.

"All of this has resulted in a higher cost of energy, lower than expected output of electricity from renewable sources and lower volumes of energy being consumed," the company told investors ahead of the annual shareholder meeting.

These market conditions could also spell trouble for other utilities, including Centrica and wind developer Orsted, which caused the European utilities stock index to plummet to two week lows. SSE lost 2.4pc to just above £13.52 a share.

SSE said that as earnings slipped, its costs have continued to rise due to “persistently high” prices on the wholesale gas market which have led to a raft of energy tariff hikes this year.

The squeeze on margins tightened as SSE lost around 130,000 customers in the three months to the end of June after it hiked bills by an average of 6.7pc in May. SSE promised investors it will still pay out a 97.5p per share dividend announced as part of a five-year plan set out two months ago.

SSE expects to shrug off its household energy customers at the end of this year, or the beginning of next year, as the new price cap bites.

Claire Perry, an energy minister, warned energy suppliers against mounting a legal challenge against the legislation which targets all standard variable tariffs.

She said the Government would “take an extremely dim view of companies that sought to frustrate the introduction of the cap, for which we have all worked so hard, by some sort of legal challenge".

SSE is focused on its own legal wrangling to secure approval for its merger with rival Big Six energy company Npower from the Competition and Markets Authority, which has undertaken a full investigation of the deal.

Katie Bickerstaffe, chief executive designate of the new SSE-Npower company, is expected to take up her appointment on Sept 24.

Yahoo Finance

Yahoo Finance