Hotels, Resorts and Cruise Lines Q2 Earnings: Sabre (NASDAQ:SABR) Simply the Best

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how hotels, resorts and cruise lines stocks fared in Q2, starting with Sabre (NASDAQ:SABR).

Hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 15 hotels, resorts and cruise lines stocks we track reported a mixed Q2. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

The Fed cut its policy rate by 50bps (half a percent) in September 2024, the first in roughly four years. This marks the end of its most pointed inflation-busting campaign since the 1980s. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be assessing whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, hotels, resorts and cruise lines stocks have held steady with share prices up 2.5% on average since the latest earnings results.

Best Q2: Sabre (NASDAQ:SABR)

Originally a division of American Airlines, Sabre (NASDAQ:SABR) is a technology provider for the global travel and tourism industry.

Sabre reported revenues of $767.2 million, up 4% year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a strong quarter for the company with a decent beat of analysts’ operating margin and earnings estimates.

Sabre achieved the highest full-year guidance raise of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $3.44.

Is now the time to buy Sabre? Access our full analysis of the earnings results here, it’s free.

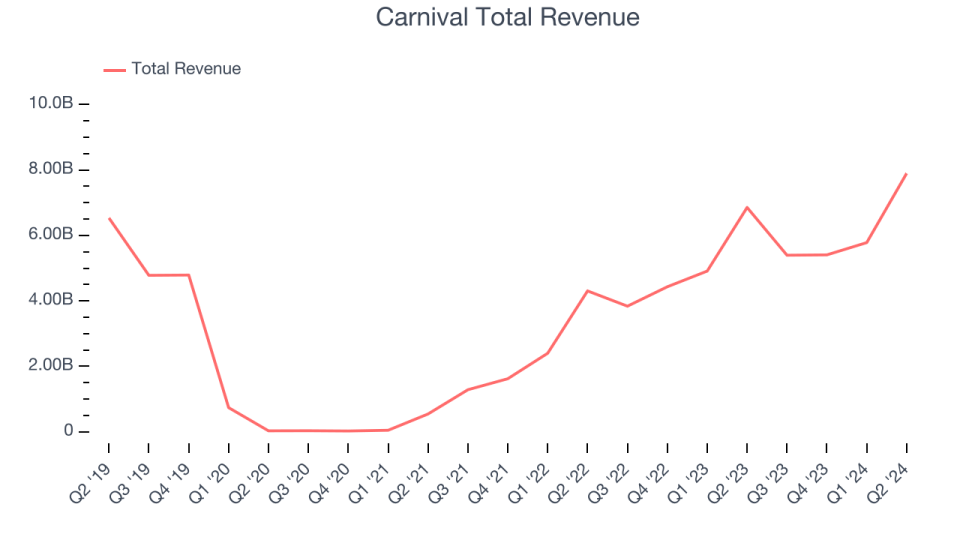

Carnival (NYSE:CCL)

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Carnival reported revenues of $7.90 billion, up 15.2% year on year, in line with analysts’ expectations. The business had a satisfactory quarter with a decent beat of analysts’ operating margin estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $18.59.

Is now the time to buy Carnival? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Marriott Vacations (NYSE:VAC)

Spun off from Marriott International in 1984, Marriott Vacations (NYSE:VAC) is a vacation company providing leisure experiences for travelers around the world.

Marriott Vacations reported revenues of $1.14 billion, down 3.2% year on year, falling short of analysts’ expectations by 5.9%. It was a disappointing quarter as it posted underwhelming earnings guidance for the full year and a miss of analysts’ operating margin estimates.

As expected, the stock is down 13.1% since the results and currently trades at $73.47.

Read our full analysis of Marriott Vacations’s results here.

Hilton Grand Vacations (NYSE:HGV)

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations (NYSE:HGV) is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.24 billion, up 22.6% year on year. This number missed analysts’ expectations by 7.7%. Overall, it was a disappointing quarter as it also recorded a miss of analysts’ earnings estimates.

Hilton Grand Vacations pulled off the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is down 5.9% since reporting and currently trades at $36.32.

Read our full, actionable report on Hilton Grand Vacations here, it’s free.

Travel + Leisure (NYSE:TNL)

Formerly known as Wyndham Destinations, Travel + Leisure (NYSE:TNL) is a global vacation company that provides travelers with vacation ownership, exchange, and travel services.

Travel + Leisure reported revenues of $985 million, up 3.8% year on year. This print was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also recorded a decent beat of analysts’ earnings estimates but a miss of analysts’ conducted tours estimates.

The stock is down 6.9% since reporting and currently trades at $46.

Read our full, actionable report on Travel + Leisure here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.