The house price bust will turn to a boom. This stock offers the chance to capitalise on it

Years of seemingly unstoppable house price growth lulled many investors into a false sense of security.

Property, though, is just like any other asset. It experiences “booms” and “busts”. Following 14 consecutive interest rate rises, an extended period of rampant inflation and anaemic economic growth that has at times teetered on recession, house prices are now finally on a downward trend.

Indeed, they have declined by about 5pc over the past 11 months. Further falls would be wholly unsurprising, since additional interest rate rises may be needed to quell an inflation rate that still stands at more than three times the Bank of England’s 2pc target.

In Questor’s view, falling house prices present a buying opportunity for investors who can look beyond short-term hype. Just as house prices never rise uninterrupted ad infinitum, they are extremely unlikely to perennially decline.

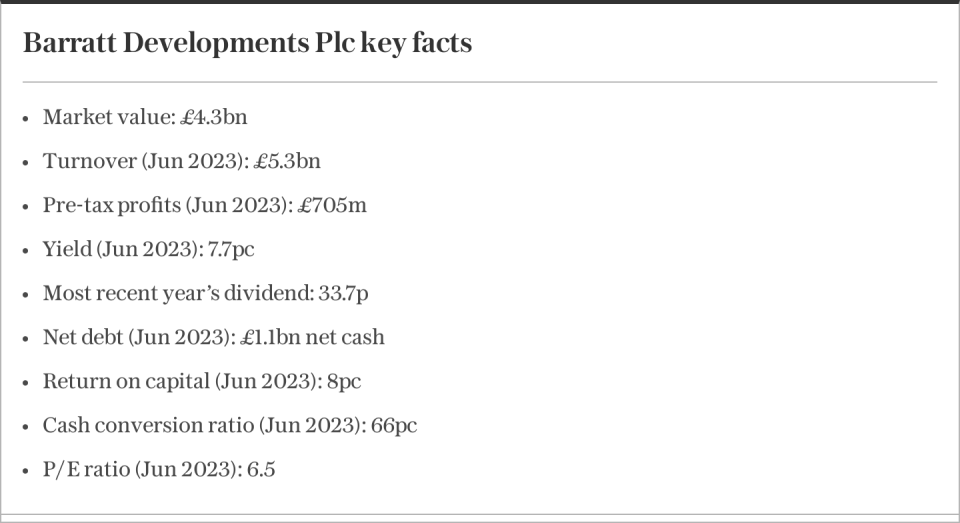

Companies with very solid balance sheets, such as housebuilder Barratt Developments, can ride out short-term challenges to deliver growing profits and rising share price.

Its full-year results last week showed it has net cash in excess of £1bn. This provides the means to not only survive the current bust so as to capitalise on the next boom, but also to buy land at relatively attractive prices. Its shares are further de-risked by their low valuation.

They currently trade on a price-to-earnings ratio of 6.7, which suggests they offer a wide margin of safety. Clearly, the firm’s near-term performance is set to suffer in a tough housing market. Although total completions in the year to June 30 declined by just 3.9pc, it expects them to fall by a further 20pc in the 2024 financial year.

So sales and profitability will almost inevitably suffer, while a further dividend cut cannot be ruled out after shareholder payouts fell by 8.7pc in the latest financial year.

Dividends, though, are set to be covered a healthy 1.75 times by net profit in the 2024 financial year. And with a 7.7pc yield, it appears investors have already priced in an additional cut in income while surplus cash is used elsewhere.

The prospects for housebuilders are highly unlikely to stay downbeat in the long run.

Inflation is set to fall to the Bank of England’s 2pc target in two years. This will ease rampant build cost inflation that contributed to a 380 basis point decline in its operating profit margin in its most recent financial year. Inflation returning to target also means additional interest rate rises may prove to be more scarce than some investors currently anticipate.

While the halcyon days of near-zero interest rates are long gone, the IMF expects Bank Rate to fall in the coming years. This could make mortgages more affordable, while an end to the cost of living crisis and a significant pickup in economic activity may further boost demand for new homes.

In terms of supply, the UK continues to struggle to build enough new homes to accommodate a growing population. England’s is forecast to rise by roughly 220,000 people per year over the next decade.

While not every individual will require a home, only 150,000 new homes were built per year, on average, over the past decade. This suggests the issue of undersupply is unlikely to be solved – even with changes to planning laws that have been mooted for years.

Indeed, the industry’s concentrated structure and the vast land banks of major housebuilders, alongside substantial barriers to entry, mean incumbents enjoy a strong position.

While Barratt’s shares could fall further in the short run after declining by 40pc since first being tipped by Questor in January 2020, they have significant long-term potential. Investors who can cope with short‑term uncertainty are likely to be highly rewarded in the next boom.

Questor says: buy

Ticker: BDEV

Share price at close: 436.8p

Update: Polarean

While Barratt has the financial strength to overcome temporary market difficulties, medical device company Polarean last week warned investors about its financial position.

Its half-year results stated that “it is anticipated that additional capital will need to be raised by the end of the second quarter of 2024 … to fund the group’s activities at their planned levels beyond this date”.

Given a lack of certainty in its future existence, Questor recommends that readers sell the stock. Its 88pc share price decline since first being tipped by this column in June 2021 is hugely disappointing. However, its risk-to-reward ratio is highly unfavourable.

Questor says: sell

Ticker: POLX

Share price at close: 10.75p

Read the latest Questor column on telegraph.co.uk every Tuesday, Wednesday, Thursday and Friday from 6am

Read Questor’s rules of investment before you follow our tips

Yahoo Finance

Yahoo Finance