A house price crash is bad news for those struggling to get on the property ladder

House prices have rocketed ever since the credit crisis. Soaring costs and stagnant wage growth has meant many the level of home ownership has collapsed among young adults, saving for even a deposit requires years of living at home on a frugal budget, and in general owning your own property seems like a dream. Even the cost of moving home is eye-watering.

So it’s unsurprising that people struggling to get a foot on the ladder aren’t reacting as negatively as the markets to Bank of England governor Mark Carney’s comments about a no-deal Brexit could cause a 35% crash in house prices. However, if we learn anything from the last housing market crash, it is not good news for anyone.

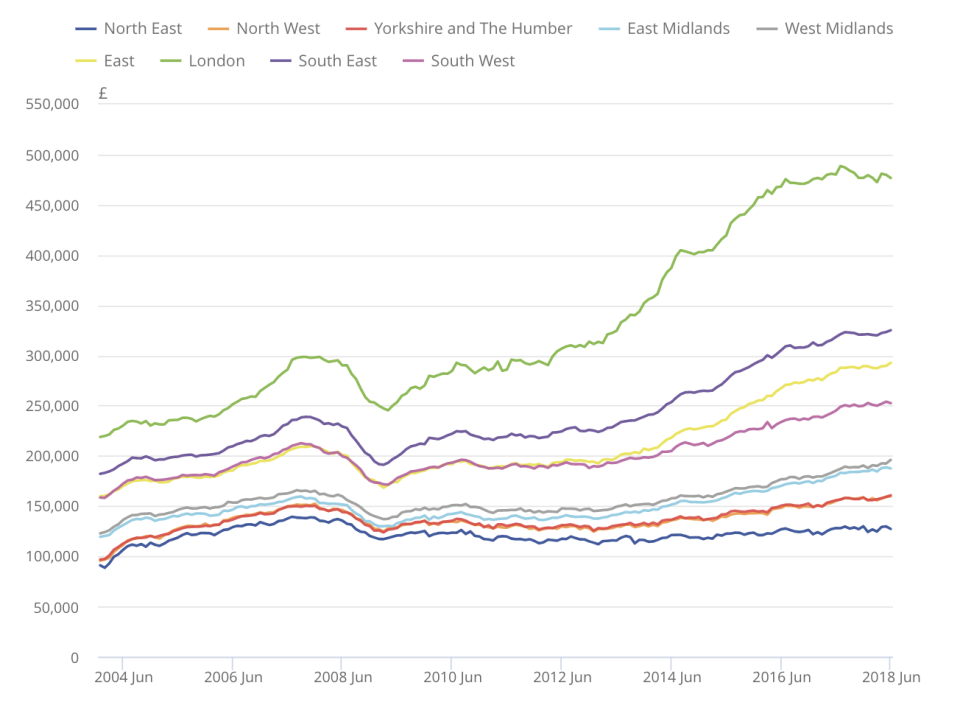

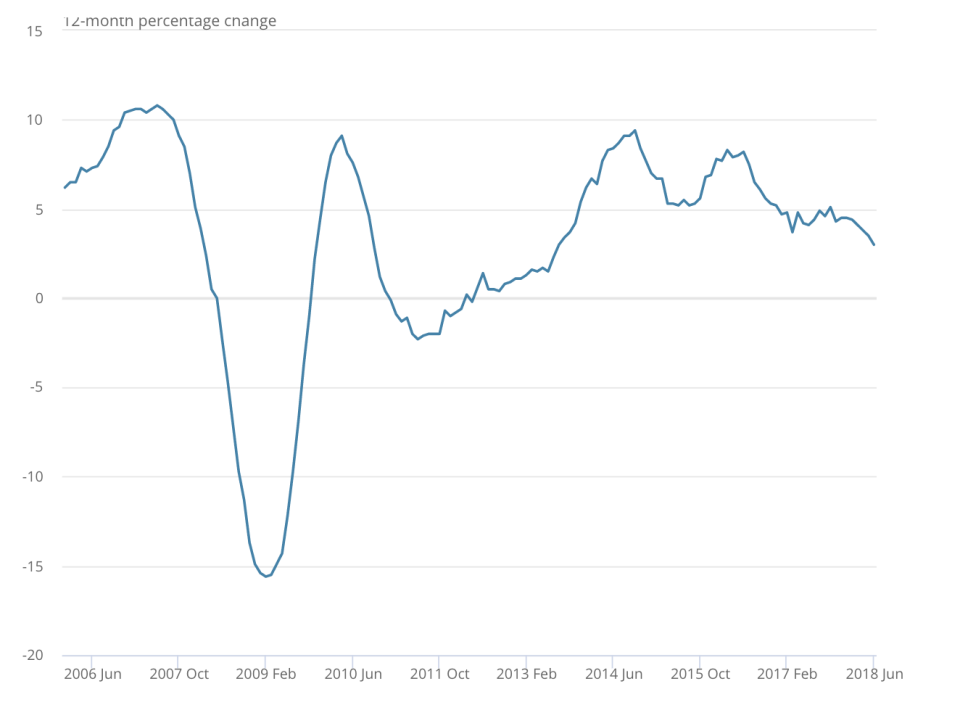

UK house prices do feel like they’re reaching a ceiling, especially in London. The average property price in the UK stood at £228,000 in June 2018, according to the latest data from the Office for National Statistics. Just look at the rapid rise in price since 2009.

In the capital, while prices suffered the largest drop in nine years most recently, it still costs, on average, £477,000. Considering the average wage in London is at £37,000, trying to squirrel enough away for a deposit, let alone get approval for a hefty mortgage, seems nigh impossible.

But a house price crash isn’t what people should hope for. Sure, a market correction would be welcomed but a sudden crash will not be beneficial for people who think they’ll suddenly be more likely to get on the housing ladder.

And here’s why.

When the financial crisis kicked off in 2008, prices crashed but, in turn, banks stopped lending generously. This meant that unless you had near perfect credit scores, a huge deposit beyond the average 5-10% of the property price deposit, then it was very unlikely you’d get a mortgage.

At the moment UK household debt is “worse than at any time on record” and, on top of that, homes in Britain face hidden debt of £19bn—all of which are starting to freak out the Bank of England and banks, to an extent. That’s one of the reasons why interest rates were raised in August.

A severe drop in prices in the housing market will spook banks, as they’re the ones which issue those mortgages and also obviously vulnerable to a downturn in real estate value. They would also be viewing the event with extreme caution, especially it means taking on the risk of lending to people who are earning little but heavily indebted and are at risk of living in a house in negative equity.

So, don’t rejoice just yet. You’re better paying off your debt as soon as possible and being in a better position to build capital and a credit score, than banking on the hope a price crash will be a way into the market.

Yahoo Finance

Yahoo Finance