House prices climb as supply falters - but the market is slowing

House prices have climbed higher, according to official figures, but a downward revision of growth late last year points to a slowing market and a sharper slowdown than perhaps previously estimated.

The Land Registry said that house prices grew 6.2pc in the year to January, below expectations, and rose by 0.8pc during the month.

But the Land Registry downgraded its initial estimates for the prior two months. Growth in December, initially reported as 7.2pc, was scaled back to 5.7pc. November was revised down from 6.1pc to 5.3pc.

Richard Snook, senior economist at PwC, said that "the significant downward revision to both the November and December figures portray a less buoyant market than previously thought."

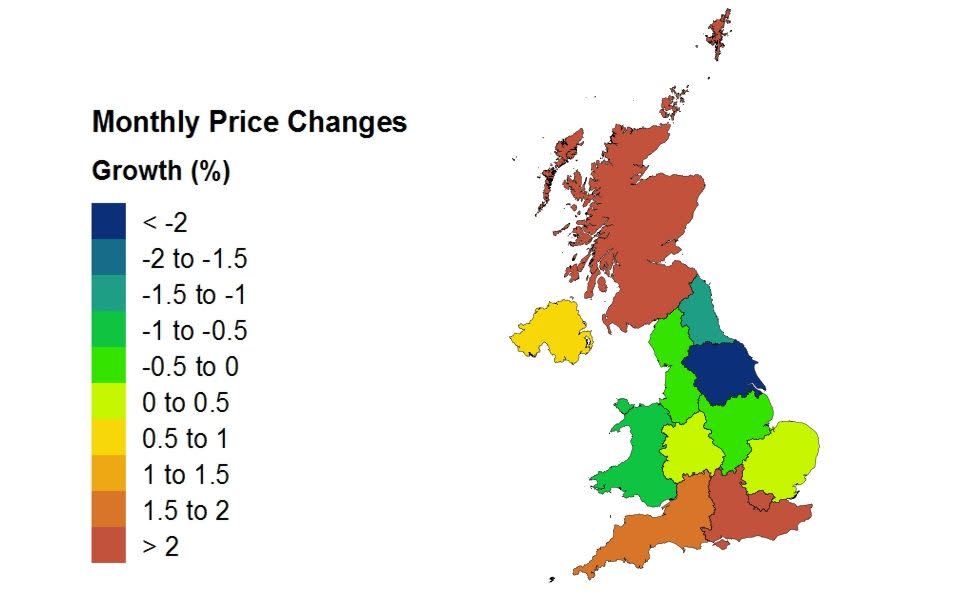

The official data also show that London led the country's house price growth, growing 3pc in January alone, boosted by very limited supply of properties on the market.

But this volatility should be taken with a pinch of salt, argues Rob Weaver, director of investments at Property Partner. He added: "December is always a quiet month for the housing market and usually rebounds in the new year."

The east, south-west and south-east of England all have stronger levels of annual house price growth than the capital, and brought the average UK house price to £218,000.

Jonathan Hopper, managing director of Garrington Property Finders, said: “All three of the UK’s fastest-rising markets have slipped below the double-digit rates of annual price growth they were clocking in 2016.

“Such blistering price inflation was always going to be unsustainable, and across the UK prices are now rising at a more halting pace as an uneasy standoff plays out between cautious buyers and sellers who know they have less competition than usual.

“While the lack of supply is steadily nudging up average prices, pragmatic vendors are realising that this is anything but a seller’s market. Astute buyers are increasingly able to ask for, and secure, sizeable discounts."

This continued house price growth will not last, said Howard Archer, economist at IHS Markit. He added: "We expect the fundamentals for house buyers to progressively deteriorate during 2017 with consumers’ purchasing power weakening markedly and the labour market likely softening.

"Increasing economic uncertainty is also likely to weigh down on consumer confidence and willingness to engage in major transactions such as buying a house."

According to HMRC, the number of homes sold is 1.9pc lower than in the same period last year, which was artificially boosted by the surge of buy-to-let before stamp duty was hiked 3pc in April.

PwC has forecast that house prices will rise between 2pc and 5pc in 2017, while ratings agency S&P said that they would increase by just 2pc.

Yahoo Finance

Yahoo Finance