House prices continue to stall with fears a 'fresh slowdown in London could be under way'

House price growth has continued to stall, according to official figures, with the monthly rate nudging up just 0.5pc.

The annual rate of growth in May was 4.7pc, down from 5.3pc in the year to April, bringing the average UK house price to £221,000. Analysts at PwC have forecast it will slow to 3.7pc in 2017, while Capital Economics has said it could reach 2pc by the end of the year.

The slumping growth rate comes amid a general slowdown of activity in the housing market: last week, the Royal Institution of Chartered Surveyors found that the number of properties for sale per branch is at a record low, with the levels of new buyers and agreed sales also depressed, particularly in London.

This suggests "that a fresh slowdown could be under way [in the capital]", said Hansen Lu of Capital Economics.

The index also measures transactions, which were down 41pc compared to May last year, 57pc in London, and represents one year after the surge of purchases before the change to stamp duty for buy-to-let landlords. Analysts at Jefferies described the data as "horrible as expected", adding that they "would anticipate a bounce back next month".

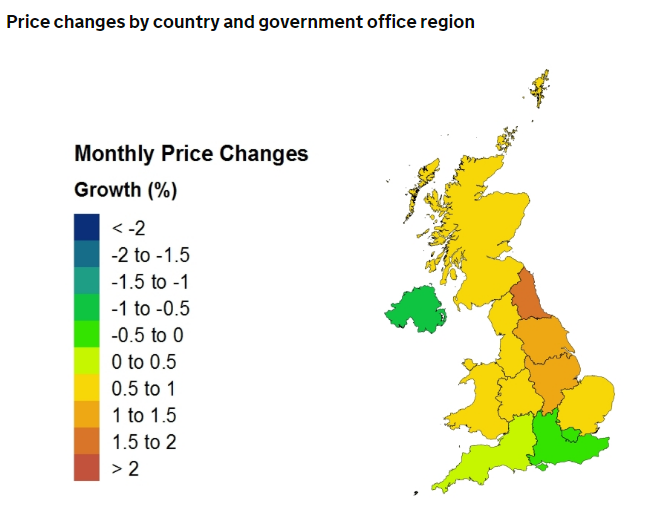

London had the second slowest increase in house prices, up just 3pc, falling 0.3pc in the last month; in the east of England that climbed to 7.5pc.

Despite the slowing trends, these figures from the Office for National Statistics "paint a much healthier picture of the market than other indices", said Samuel Tombs of Pantheon Macroeconomics. "According to Nationwide, Halifax and Rightmove, house prices rose only 2.2pc, 3.4pc and 3.0pc year-over-year, respectively, in May.

"The official measure is based on all housing transactions — regardless of the purchase method or whether the property is new or old — so it should be the best indicator of the market. The official data shouldn’t be trusted blindly, however, because it is often revised substantially".

Mr Lu said that the index could be inflated due to the higher readings of new-build properties, which it found had increased in value by 9.1pc, compared to 4.4pc for second-hand homes. He added that "five of the last six months have seen initial estimates of new-build house price growth subsequently revised downwards".

Yahoo Finance

Yahoo Finance