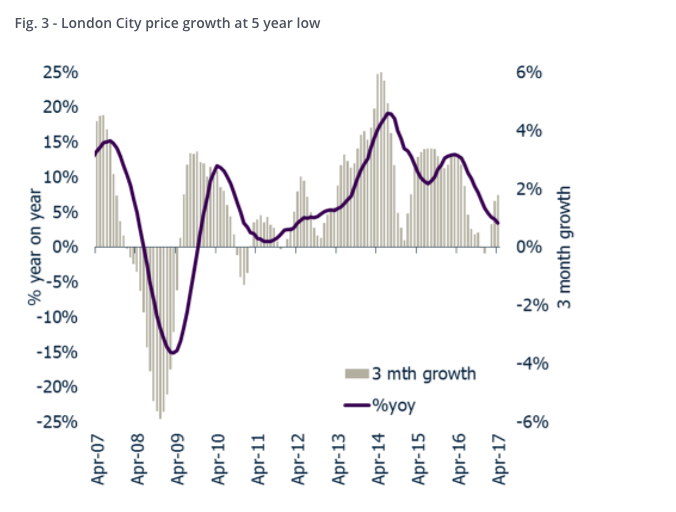

House prices in London are growing at their slowest rate in 5 years

Peter Macdiarmid/Getty Images

LONDON – The supercharged London housing market is slowing down.

According to data from Hometrack UK, the annual rate of house price growth in London declined from 13% a year ago to just 3.5% last month, the lowest growth rate since 2012.

"Looking ahead we expect current trends to continue with house price growth losing momentum in cities across southern England where housing unaffordability is at a record high and has priced large numbers of households out of the market," Hometrack said.

"Weaker investor demand supports this trend, taking demand out of the market and adding to supply as investors look to rationalise and de-leverage portfolios in the wake of tax changes."

If inflation rises above the 2-3% growth expected, London could see its first real decline in house prices since 2011, according to the study.

A combination of Brexit uncertainty, stamp duty changes and a rule change to ensure foreign companies must register before buying property has taken the heat out of the market.

Here's the chart:

Hometrack

The same pattern has been seen across housing markets in other cities in Southern England.

Hometrack said:

"Cambridge, Oxford and Bristol have all seen the rate of growth slow from double to single digits over the last year. This steep deceleration in growth reflects weaker levels of demand from home owners and investors in the face of affordability constraints, tax changes and weaker market sentiment."

NOW WATCH: Here's how Jay Z and Beyoncé spend their $1.16 billion

See Also:

The FCA is making sure the UK's biggest asset managers have a plan for Brexit

The price of luxury flats in South London areas like Battersea and Nine Elms is diving

The return of 190,000 retired expats after Brexit could cost the NHS £1 billion

SEE ALSO: House prices in London are being cut as the once-crazy market continues to cool

Yahoo Finance

Yahoo Finance