House prices in Wales jump by 7.8% annually as UK property values hit fresh high

UK house prices reached a fresh high of £235,000 on average in November 2019 as property values across Wales surged by nearly 8% year-on-year, official figures show.

The average UK house price in November 2019 was £5,000 higher than a year earlier, when it stood at around £230,000.

The Office for National Statistics (ONS), which released the figures with the Land Registry, said November’s average house price of £235,000 is a joint record high for the index, with the September 2019 level also being £235,000.

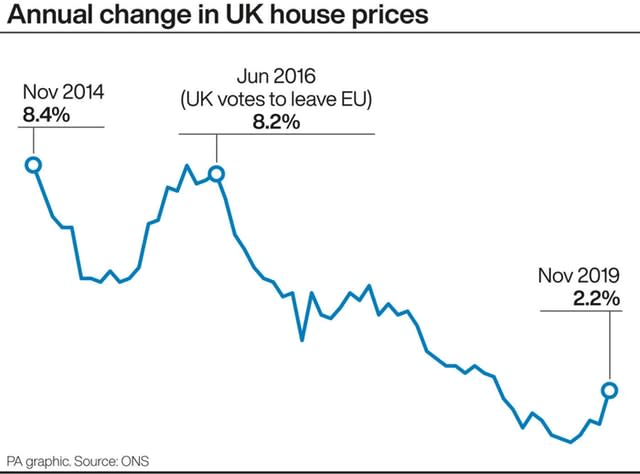

Annual house price growth accelerated in November to 2.2%, up from 1.3% in October.

Average house prices increased over the year in England to £251,000 (a 1.7% annual increase), in Wales to £173,000 (7.8%), in Scotland to £155,000 (3.5%) and in Northern Ireland to £140,000 (4.0%).

In October 2019, annual house price growth in Wales stood at 3.6%.

The report said November’s 7.8% annual house price jump in Wales was driven by a shift towards higher-value homes changing hands in areas which tend to have high numbers of property sales, such as Cardiff and nearby Newport.

A fall in prices during the same period in 2018 also contributed.

Some commentators have previously suggested that the abolition of the Severn crossing tolls has boosted demand for homes in Wales, where house hunters may find better value compared with England.

Meanwhile, in England, annual house price growth in November was driven by the West Midlands (4.0%) and North West (3.8%).

The lowest annual growth rate was in the East of England, where prices fell by 0.7% year-on-year, followed by London which saw annual house price growth of 0.2%.

While house price growth in London was low, the area remains the UK’s most expensive place to purchase a property, at an average of £475,000.

ONS head of inflation Mike Hardie said: “Annual house price growth picked up, with all regions growing apart from the East of England.

“After almost two years of poor growth, London house prices appear to be showing some signs of improvement.”

The North East, where the average house price is £131,000, is the only English region where property values are yet to surpass their pre-economic downturn peak of July 2007.

The figures were released as a separate report from trade association UK Finance said the number of mortgages being handed out to first-time buyers and home movers was down by around 10% in November 2019 compared with a year earlier.

UK Finance said 30,620 new first-time buyer mortgages were completed in November 2019, 10.5% fewer than in the same month in 2018.

There were 30,750 home mover mortgages completed in November 2019, 10.6% down on the same month a year earlier.

UK Finance said the fall came after particularly strong house purchase activity in November 2018.

Howard Archer, chief economic adviser at EY ITEM Club, said: “It is possible that house prices got a boost in November and December from some buyers keen to get their move done before the general election to avoid any shocks or uncertainties that could arise.”

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said that looking ahead, falling mortgage rates combined “with the reduction in domestic political uncertainty should ensure that house prices continue to climb over the coming months”.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said of UK Finance’s mortgage lending figures: “Hopefully this is a blip and should pick up again as lenders remain extremely keen to lend, with plenty of mortgages at high loan-to-values and competitive rates.

“First-time buyers are the lifeblood of the market and their importance to its overall health shouldn’t be underestimated.”

Commenting on today’s house price figures, our head of inflation Mike Hardie said: https://t.co/iexkbJzBQD pic.twitter.com/bx5Ow2lGx7

— Office for National Statistics (@ONS) January 15, 2020

Jeremy Leaf, a north London estate agent and a former residential chairman of the Royal Institution of Chartered Surveyors (Rics), said the ONS/Land Registry figures “confirm market resilience we have been seeing on the ground for some time, despite considerable political turmoil in the build-up to the election and Brexit uncertainty”.

Sam Mitchell, chief executive at online estate agent Housesimple, said: “November feels like a distant memory as already in 2020 we have seen a huge spike in activity after the political certainty of a decisive general election, bringing with it a positive impact on the housing market.

“As confidence returns to the market and the ‘Boris bounce’ boosts the sector, we should see this positivity feed through into further increasing transactions and price increases.

“Early indications from other house price data sources have already shown much-needed signs of growth, which will come as music to the ears of sellers looking to list in 2020.”

Yahoo Finance

Yahoo Finance