Housing crisis spells end of the bachelor pad as men struggle to buy

It was once considered as a right of passage for young men who had flown the nest and wanted to enjoy the single life undisturbed.

But new figures suggest that the traditional bachelor pad is becoming an outdated concept, with an increasing number of men doubting their ability to get a foot on the property ladder without the help of a partner.

Research by Halifax, a mortgage lender, found nearly half of 18 to 35 year-olds are relying on a partner to help them get onto the property ladder.

Men were twice as likely than women to say that not being able to buy with someone else is a barrier to getting on the property ladder, Halifax found, suggesting that bachelor pads are well and truly dying out.

Some 18 per cent of men and 9 per cent of women thought they would need to buy a property jointly or carry on renting.

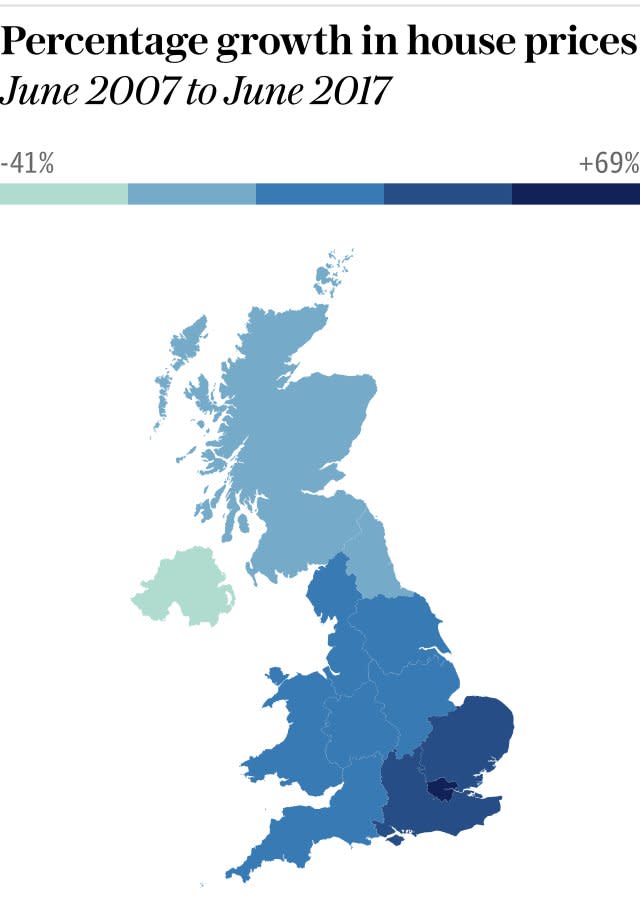

It comes as soaring house prices have far outstripped young people's wages, which have remained relatively stagnant in real terms since the financial crisis in 2008.

Earlier this year the average UK first-time buyer deposit reached £32,899, a sum higher than the average UK annual wage.

Overall a lack of income was seen as the biggest barrier for young people getting on the property ladder, with 55 per cent of men blaming their salaries, compared with 70 per cent of women.

House prices are now so high in relation to wages that nearly half of first-time buyers said they would buy with a partner, if they hadn't done so already.

It comes after self-made millionaire and luxury property developer Tim Gurner, enraged Millennials by suggesting that the housing crisis would be solved if they stopped eating avocado on toast.

He said: “When I was trying to buy my first home, I wasn’t buying smashed avocado for $19 and four coffees at $4 each,” he said. “We’re at a point now where the expectations of younger people are very, very high.

He also claimed that the problem will dissolve when the young inherit "huge wealth" from their baby boomer relatives.

Martin Ellis, a housing economist at Halifax, said: “It’s not difficult to see why so many young people are now waiting for a partner to take their first step onto the property ladder.

“With many people trying to fund day to day living while saving for a deposit for a first home may not even be able to imagine raising this amount of cash on top of all their regular outgoings, first-time buyers in the UK are still on average £651 a year better off buying their own home compared to renting.

“Getting to grips with the property market jargon, calculating what’s affordable and understanding borrowing options available – including Government schemes – will help bring people looking to own their own home closer to the first step, no matter how far away they feel they are from reaching that first rung.”

Yahoo Finance

Yahoo Finance