HP Reduces Profit Forecast as PC Sales Continue to Slide

(Bloomberg) -- HP Inc. reported quarterly sales that missed estimates and reduced its annual profit forecast on falling demand for personal computers and printers, especially among consumers. The shares fell in extended trading.

Most Read from Bloomberg

Russia Privately Warns of Deep and Prolonged Economic Damage

California Avoids Blackouts With Bigger Test Ahead as Heat Looms

World’s Deadliest Roads in Focus After Billionaire’s Fatal Crash

Russia Sanctions Ben Stiller, Sean Penn After Latest US Measures

Fiscal third-quarter revenue fell 4.1% to $14.7 billion, the Palo Alto, California-based company said Tuesday in a statement. Analysts, on average, projected $15.6 billion. Consumer sales in its computer division declined 20%, led by cratering demand for notebooks.

HP also reduced its annual profit forecast to $4.02 to $4.12 a share, excluding some items, from $4.24 to $4.38 a share. Analysts, on average, estimated $4.30, according to data compiled by Bloomberg.

“Like many other companies, our revenue has been impacted by worsening consumer demand that we expect is going to continue is Q4,” Chief Executive Officer Enrique Lores said in an interview. “This situation will probably last for a couple more quarters.”

Revenue generated by the Personal Systems division -- including PCs -- dropped 3% to $10.1 billion in the period ended July 31. While sales to consumers fell, commercial revenue increased 7%. Total unit shipments tumbled 25%, with notebooks down 32%.

HP’s higher mix of commercial PCs has served as a shield from the plunging consumer market in recent months, but Lores said the company is also starting to see a slowdown in business demand. This phenomenon contributed to the forecast reduction, Lores added.

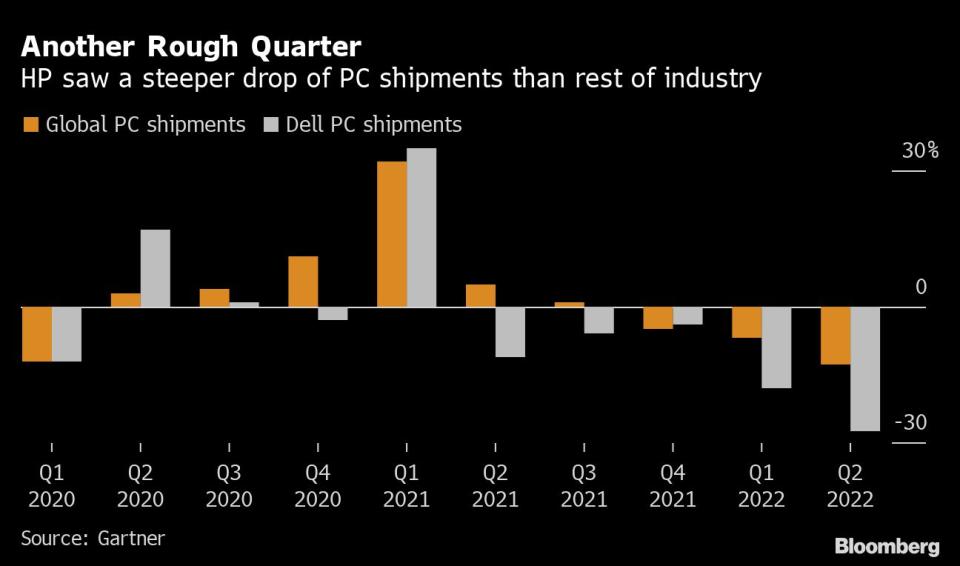

PC demand, which boomed early in the pandemic, has fallen off as schools reopened and economic sentiment soured. Global shipments declined 13% from April to June -- the worst quarter in more than nine years, according to Gartner Inc., an industry analyst. HP experienced a drop of more than 27%, the worst of any company tracked by Gartner.

In the quarter, printing revenue fell 6% to $4.6 billion, missing analyst estimates of $4.8 billion. The segment continues to be hurt by supply-chain shortages and backlogs, Citigroup analysts Jim Suva and Asiya Merchant wrote before the earnings were released.

Profit, excluding some items, was $1.04, one cent below estimates. The company has been focused on cutting costs in recent years, Lores said.

The shares declined about 6.8% in early trading on Wednesday before markets opened in New York. The stock has dropped 17% this year.

Earlier this week, HP completed its $3.3 billion deal for Poly, the company formerly known as Plantronics Inc., which sells phone headsets and other audio and video accessories. The acquisition is a bet on the lasting demand for remote work equipment.

(Updates with premarket trading in penultimate paragraph)

Most Read from Bloomberg Businessweek

Women Who Stay Single and Don’t Have Kids Are Getting Richer

Startup Wants to Chart Path to More Equitable Urban Development

A New Contaminant Found in Popular Drugs Could Cost Big Pharma Millions

Russia’s Conspiracy-Theory Factory Is Swaying a Brand-New Audience

©2022 Bloomberg L.P.

Yahoo Finance

Yahoo Finance