HSBC: Growth in Asia is dependent on debt and it 'can't go on forever'

Beawiharta/Reuters

Asia has a debt problem and it's not just in China.

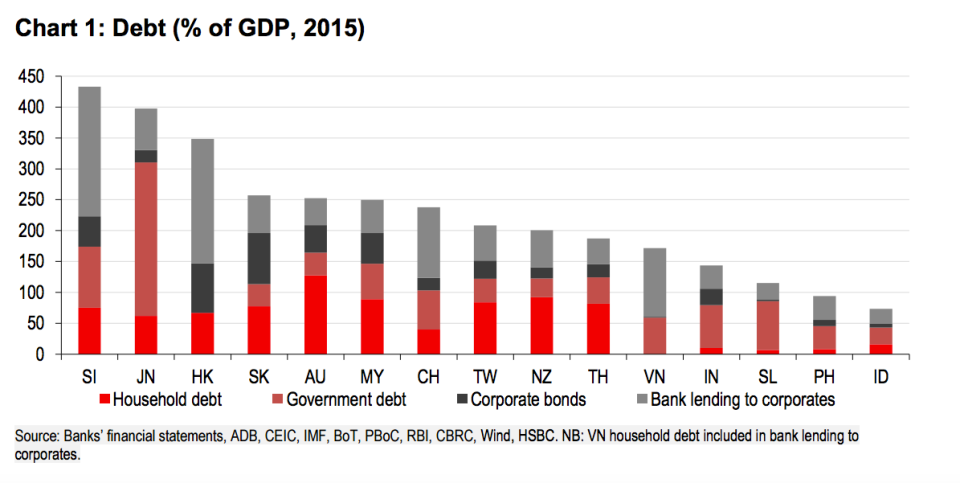

While China is the focus of a lot of investors' worries about the level of its debt, it's not the most highly leveraged country in the region.

As HSBC analysts point out in a round up of Asian debt trends, Korea, Australia, and Malaysia have higher debt-to-GDP ratios, and each have "elevated" levels of household debt.

Meanwhile the usual suspects of Singapore, Hong Kong and Japan still register at the top of the debt scale thanks to their booming financial centres and international lending.

Here's the chart from HSBC:

Beawiharta/Reuters

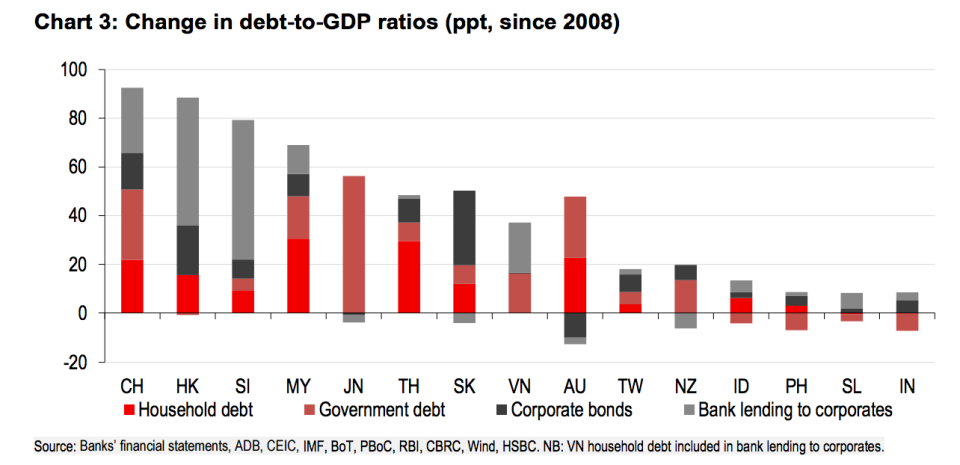

That said, China still leads the class on debt added since 2008, with the worry being that the country has become too dependent on credit as fuel for its economic growth.

Here's the chart:

Beawiharta/Reuters

While a lot of the region, and even Australia, has piled on debt since the 2008 financial crisis, a few countries have stayed below the 20% mark, such as Indonesia, India and the Philippines. These are the places to run if you want to be exposed to Asia's growth, but not necessarily a debt bubble bursting, according to HSBC:

The worry is that growth across much of Asia continues to be highly credit dependent. That can’t go on forever: the higher debt-to-GDP ratios climb, the more likely a sudden, and painful, correction becomes.

At the same time, the edifice isn’t quite as brittle as sceptics often argue: debt, after all, has still increased over the past year despite relentless financial volatility. Also, it’s not as if everyone has leveraged up to the same extent.

If you are worried about what debt in general means for the region’s growth prospects, then Indonesia, India, and the Philippines may be good places to hide.

NOW WATCH: Examples of Michael Jordan's insane competitiveness

See Also:

GOLDMAN SACHS: China's 7-year debt boom is one of the biggest and fastest in history

Britain's former financial regulator just nailed one of the biggest problems in the global economy

SEE ALSO: Germany's most watched bond just did something it has never done before

Yahoo Finance

Yahoo Finance