HSBC: Chinese borrowers are enjoying the easiest money in 3 years

Reuters

Borrowing in China is getting easier, but the government needs to spend more to stop a decline in investment, according to HSBC analysts.

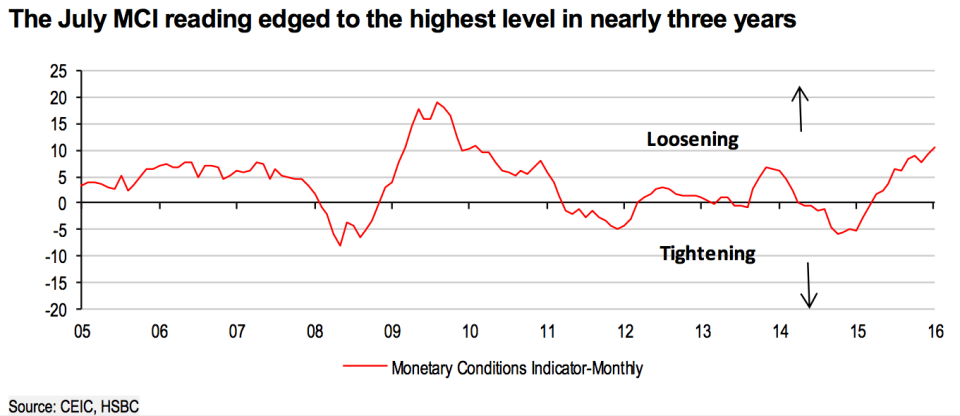

HSBC's Monetary Conditions Indicator, which measures how much and how cheaply new credit is created, showed that monetary conditions were the loosest in three years in July.

The index, compiled by HSBC analysts led by Julia Wang and Qu Hongbin, jumped from a reading of 9.3 in June 2015 to 10.5 a month later. It means that businesses should find it easier to finance their activities with debt.

Monetary conditions have eased this year because the central bank has pumped liquidity into the system and signalled it would do more if China got into trouble. But the effectiveness of this policy has its limits. The country needs a more active fiscal, or government spending, policy and cannot keep relying on its central bank.

"However, the economy is not yet out of the woods, in our view. Importantly, the slowdown in private sector investment shows no signs of abating. Private investment fell by -1.2% y-o-y in July 2016, the slowest reading on record," HSBC said in the research note to clients published on Monday.

Credit might be plentiful and cheap in China but the country needs a spending boost from the government to keep investor concerns about the economy at bay, according to HSBC.

Here is HSBC (emphasis ours):

"China continues to face persistent headwinds from a weak external sector and deteriorating business sentiment.

"As such, although overall policy action has been largely supportive and has helped indeed bring about some stabilisation over recent months, these downside risks warrant an acceleration in the pace of policy easing and implementation of reforms.

"Given already accommodative monetary conditions, we believe policymakers should focus more on fiscal expansion to channel liquidity from the financial system towards the real economy. Reforms should also be accelerated to arrest the deterioration in business confidence and private investment, in our view."

And here is the chart which shows monetary conditions as loose as at any time in the past three years:

Reuters

NOW WATCH: Kobe Bryant is starting a $100-million venture capital fund

See Also:

SEE ALSO: China has taken over Scotland's North Sea oil production

Yahoo Finance

Yahoo Finance