HSBC boss John Flint warns of US-China trade war risks after results fail to impress City

HSBC chief John Flint has warned of the risks posed by a US-China trade war, after underwhelming second quarter results for the Asia-focussed lender disappointed the City.

Mr Flint, who took the helm at HSBC in February, said an escalation in trade tariffs by both countries had the potential to slow China’s growth and in turn damage the bank.

HSBC has been shifting resources to Asia over the past few years and now generates almost 90pc of its profits from the continent.

Beijing warned it was ready to endure a “protracted” trade war last night after lining up $60bn (£46bn) of new tariffs on US goods in recent days. An op-ed piece in state media The Global Times claimed the US had “lost its mind on trade”.

Mr Flint admitted HSBC was exposed to the fallout from any trade war, but said tensions had so far not impacted the firm.

“I think if there is a full-blown trade war, goodness knows what that might mean. Could that impact our business? Of course,” he said.

“We’re one of the world’s leading trade banks, we’re a business that enjoys good market sentiment. We do a lot of business in the private banking space and we could be impacted in that way.

“So I don’t want to be dismissive of it, but equally while we recognise the potential threat we haven’t seen anything yet manifest itself in our business.”

The HSBC boss added: “The full impact is very difficult to estimate. It is possible it will shave China’s GDP growth but it’s too early to tell.

“We will keep an eye on market sentiment generally and whether it hits investment.”

Europe's largest lender by assets posted a 5pc rise in pre-tax profits to $10.7bn (£8.2bn) for the first half of the year, up from $10.2bn the year before.

However adjusted pre-tax profits - which strip out one-off costs - were down 2pc to $12.1bn. This was due to an 8pc rise in operating costs to $16.4bn.

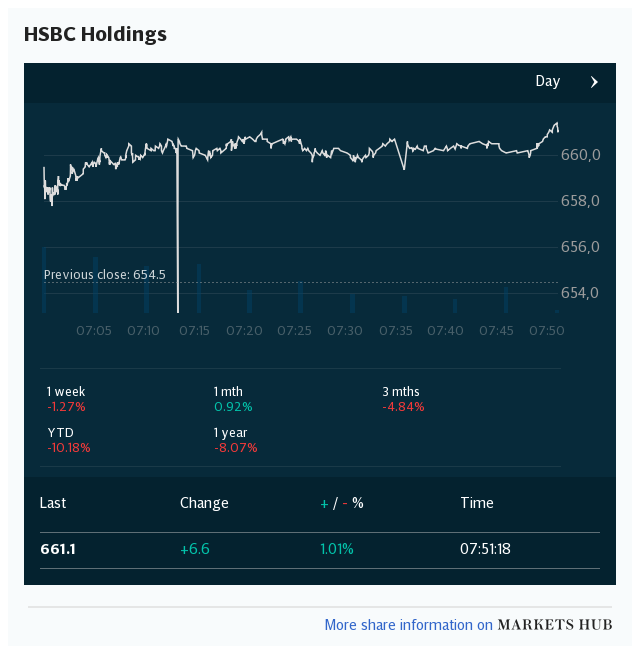

Analysts at Keefe, Bruyette & Woods said HSBC had had a "tough quarter" and the City's focus would be on the weakness in underlying profits. HSBC shares were down around 0.6pc in lunchtime trading at 711p.

Mr Flint said the rise in costs reflected major investment in new hires and digital banking under a three-year strategy he unveiled earlier this year.

He reiterated that HSBC’s UK bank was targeting aggressive growth, particularly in the mortgage market.

HSBC UK had around $50bn (£39bn) of excess capital to invest in expansion following restructuring done earlier this year to comply with Government ring-fencing rules, he said. Costs related to Brexit were unchanged at around $300m.

HSBC chairman Mark Tucker said he remained "cautiously optimistic" about the outlook for global growth despite the threat of a trade war.

"In particular, the fundamentals of Asia remain strong despite rising concerns around the future of international trade and protectionism," he said.

Yahoo Finance

Yahoo Finance