HSBC text message scam: ‘unusual login on your account’

Scammers are targeting HSBC customers with a new text message scam aimed at draining their bank accounts.

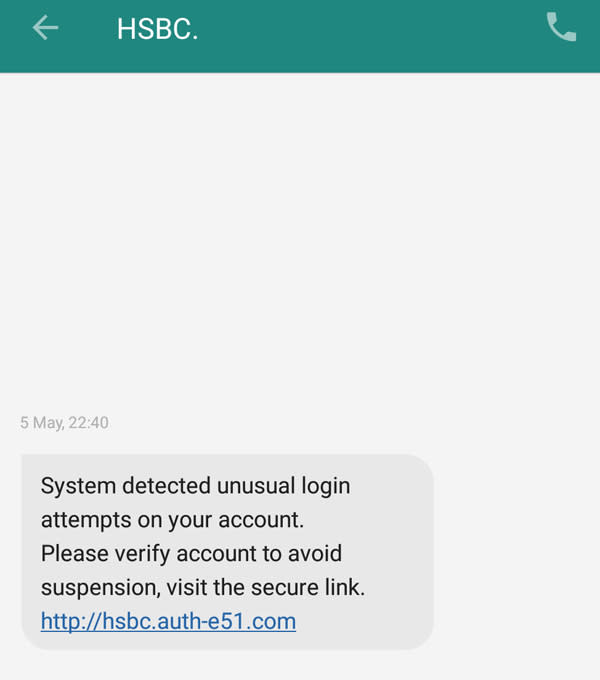

The latest scam appears on the victim’s phone as being from “HSBC.” (note the full stop at the end) and claims the bank has “detected unusual login attempts on your account.”

It then asks users to click on a link in the text in order to “verify account to avoid suspension”.

As is common practice with these scams, the link takes you to a fake webpage that looks like HSBC but is designed to steal victim’s banking logins.

How believable is it?

If you weren’t paying close attention, it might look like it’s been sent from HSBC.

What’s more, the fake link the scammers ask you to click on looks believable and there are no spelling mistakes (although there are clear grammatical errors).

The messages are sent out randomly so they aren't specifically targeted at HSBC customers. However, the law of averages mean some who bank with them will receive the 'alert'.

So while it’s not the most convincing scam we’ve ever seen, it’s easy to see why a less tech savvy HSBC customer might fall victim –especially if they had already signed up to text message alerts from their bank.

How to stay safe

These banking scams are depressingly commonplace – you can see our coverage of Nationwide and Santander variants here.

The advice for staying safe is always the same, regardless of which bank is mentioned: just ignore and delete the message.

If you’re worried your account might actually have been fraudulently accessed, NEVER click on a link or call a number contained in the message.

Instead, look up your bank’s details separately – either on an earlier bank statement or via a search engine – and contact them that way.

Yahoo Finance

Yahoo Finance