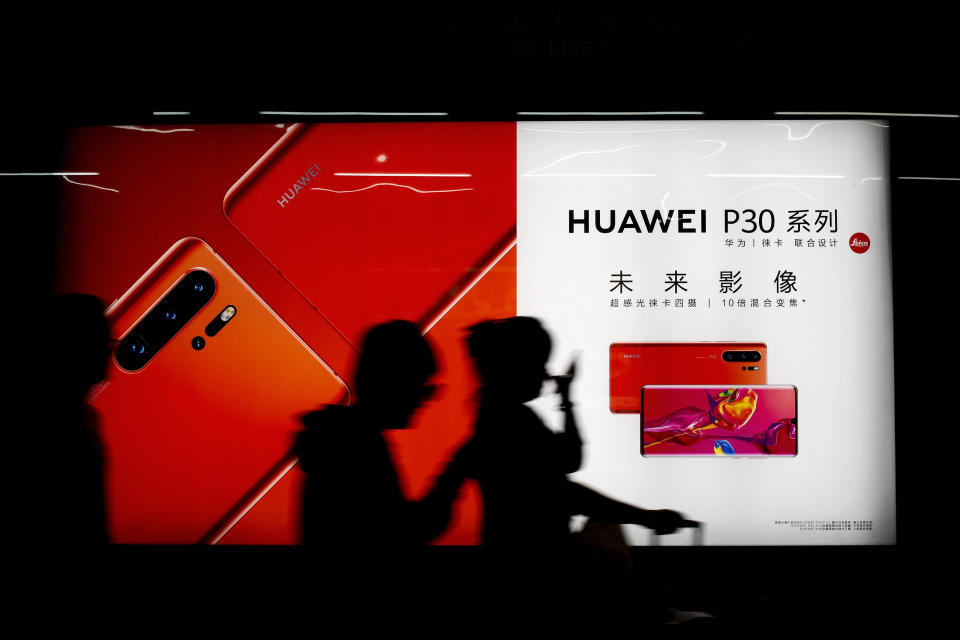

Huawei ban in U.S. will lead to 'global ripple effect'

Washington’s fight with Huawei Technologies escalated to a new level Wednesday, after the Department of Commerce moved to ban the telecommunications giant from buying parts and components from U.S. companies.

The dramatic move came hours after President Donald Trump signed an executive order enabling the U.S. to ban telecommunications equipment from “foreign adversaries” that are “increasingly creating and exploiting vulnerabilities” in information and communications technology. While the President’s order did not single out Huawei or China, it follows days of tit-for-tat moves between Washington and Beijing, with both sides raising tariffs in the ongoing trade dispute.

The Chinese company said the latest salvo would limit U.S customers to “inferior yet more expensive alternatives, leaving the U.S. lagging behind in 5G deployment” in a statement released to Yahoo Finance. It added “unreasonable restrictions will infringe upon Huawei's rights and raise other serious legal issues.”

“The question is, is this the Trump administration now pulling out all the stops in a crucial moment of the trade negotiations in a last ditch effort to get the Chinese side to the table,” said Samm Sacks, a Cybersecurity Policy and China Digital Economy Fellow at New America. “I suspect not, because what I’ve seen from both sides is a determination to dig in. It’ll be very difficult to walk this one back.”

‘It would hit virtually all of Huawei’s products’

The Department of Commerce order places Huawei and 70 affiliates on a so-called “entity-list,” and requires the company to obtain a government license to buy or transfer American technology. The department said it had “a reasonable basis to conclude that Huawei is engaged in activities that are contrary to U.S. national security or foreign policy interest,” citing its alleged attempt to cover up prohibited financial services activities to Iran, revealed in a 13-count indictment hat was unsealed in January.

U.S. actions banning Huawei from sourcing U.S. components marks a serious blow to the company, at a time when it is looking to win 5G contracts globally. A company spokesperson said Huawei spent $16 billion on procurement within the U.S. last year, although he didn’t specify how significant that amount was, in relation to its parts suppliers globally.

The Commerce Department’s order could also hurt U.S. suppliers, including Qualcomm, Broadcom, and Western Digital A similar purchasing ban on Huawei’s Chinese rival ZTE, which counts Qualcomm as one of its biggest suppliers, nearly crippled the company last year.

Full implementation of the entity list would not only put Huawei at risk but its network of suppliers around the world, according to Eurasia Group.

“The firm would be unable to upgrade software and conduct routine maintenance and hardware replacement,” Eurasia Group analysts said in a note. “It would hit virtually all of Huawei’s products, including high-end smart phones, mobile infrastructure, data centers and cloud services.”

The one-two punch Wednesday follows a months long campaign by the U.S. to convince allies to ban Huawei equipment from their 5G infrastructure, on national security concerns. While countries like Australia and New Zealand have followed suit, the Europeans have largely taken a more nuanced approach, choosing to integrate Huawei equipment with additional security measures in place.

Sacks said U.S. actions would lead to a “global ripple effect” with so many countries relying on Huawei equipment for its mobile infrastructure.

“Think about the European companies and networks in Europe that rely on Huawei gear,” she said. “Huawei is dependent on U.S. components. So if they can’t (buy them), this is not just a U.S.-China issue anymore,” she said.

—

Akiko Fujita is an anchor and reporter for Yahoo Finance. Follow her on Twitter at @AkikoFujita

More from Akiko:

'The ultimate insult': How U.S.-listed Chinese companies are gaming American investors'

Really bad business practice': U.S. security experts sound off on Huawei

U.S.-China showdown: Huawei has 'completely taken over' the Mobile World Congress

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance