HubSpot (HUBS) Lining Up As A Buy

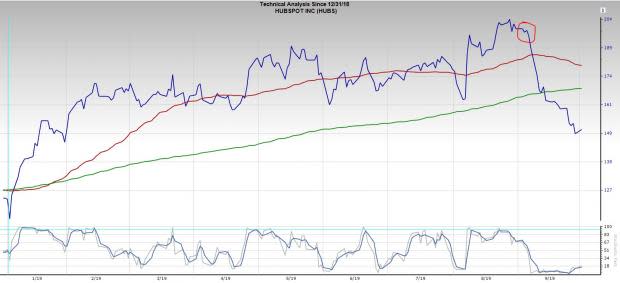

One of my favorite enterprise cloud stocks is lining up as a buy. HubSpot (HUBS) is trading at its lowest levels since the end of January and there has been nothing but good news surrounding this company. Full year EPS guidance and estimates have been risen as the firm demonstrates strong top and bottom-line beats in its Q2 earnings release back in early August.

Analyst Day

The 23.4% breakdown in price seemed to originate from HubSpot’s Analyst Day on September 4th. Investors came away concerned about price increases that would sizably impact its larger customers.

Hubspot unveiled its new cost structures during Analyst Day, which illustrated tiers of price increases for its Marketing Hub. The smallest customers would experience no change while its largest customers would see as much as a 668% subscription rate increase. The Sales Hub is going to see a 25% increase across the board. These rate changes are going to take effect on November 1st, which will impact Q4 earnings.

The Marketing Hub is the company’s bread & butter and investors are concerned that this price hike is going to hurt the company’s growth outlook. I don’t see these hikes negatively impacting the topline as much as investors are pricing in and neither do most of my sell-side cohorts. I believe that this dip has created a buying opportunity for those of us that missed out on HUBS 2019 gains, and those that want to double down on this compelling company.

Reason to Buy

HubSpot has been building out its product offering and improving functionality in its Marketing and Sales Hubs, as well as its continuing to expand the relatively new Service Hub, which was launched back in 2017. Today almost 40% of HubSpot’s 65,000 customers use at least 2 of its 3 Hubs. Below is a chart taken from the Analysts Day Presentationillustrating the multi Hub growth.

Customers are becoming intertwined into the company’s Hubs and integrating into the platform’s compelling product offering. The rate escalation shouldn’t impact HubSpot’s growth and customer retention levels due to the necessity of the company’s unique services. The price increase is in line with the company’s growth trajectory.

Sell-side analysts remain optimistic about the future of this company with the average target share price being just north of $200. HUBS was trading around the $200 level before Analysts Day (circled in red), but has since traded down to the $150 level, creating the buying opportunity that we are seeing today.

The Business

HubSpot provides cloud-based marketing, sales, and service management software along with free CRM. The company has positioned their platform to cater to growing small and mid-sized businesses (SMBs). This niche has made HUBS a leader in the SMB enterprise cloud space.

The firm’s top competitors are Salesforce (CRM) and Oracle (ORCL). HUBS focus on smaller growth companies has given it the upper hand in the SMB market, which isn’t even scratching the surface of full penetration. Its dynamic pricing makes it affordable for businesses of any size.

Over 300 third party apps are available in its App Marketplace, with over 700,000 cumulative integrations. This ability to integrate such a wide variety of applications further increases the attractiveness of the firm’s product offering.

Take Away

HubSpot is the market leader in its category and continues to impress customers and analysts alike. The company’s Analyst Day in early September excited analysts, but made investors anxious about its ability to successfully push higher prices on customers.

HubSpot is a company of the future and its dip to $150 has created a great buying opportunity. I put a small position on this morning and am planning on adding to it incrementally if the share price continues to fall.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our just-released Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

Download Free Report Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oracle Corporation (ORCL) : Free Stock Analysis Report

HubSpot, Inc. (HUBS) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance