A huge wildfire is disrupting oil production in Canada — and now crude is surging

Oil is on a massive charge on Thursday, surging after a huge wildfire disrupted production in Canada and after news that production in the US fell to its lowest levels in 18 months.

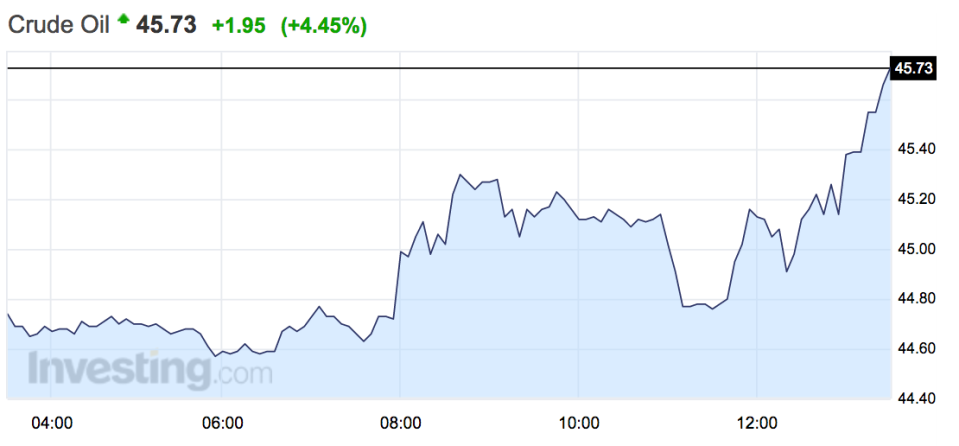

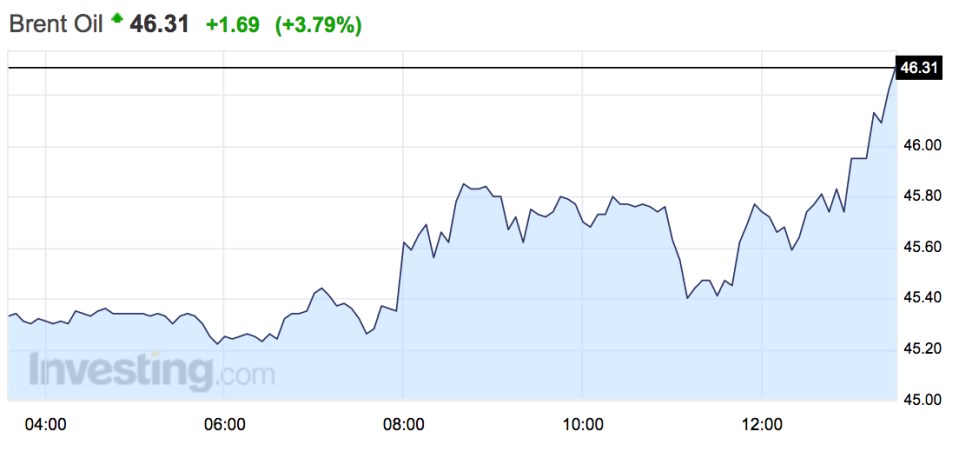

Just after 1:30 p.m. BST (8:30 a.m. ET) the two major oil benchmarks — West Texas Intermediate and Brent crude — have popped 4.45% and 3.8%, getting an unexpected boost after a huge wildfire in Canada's oil-producing region disrupted production there. "Our understanding is that up to 800,000 barrels a day of production has been (or is in the process of being) shut down," analysts at Energy Aspects said, as first quoted by the Financial Times. "The situation remains fluid and further disruptions cannot be ruled out."

The US production drop also gave another suggestion to investors that the market may be on its way to balancing.

Both major benchmarks are now above $45 a barrel. Here's how things look in the markets right now:

Investing.com

Investing.com

Oil's charge is also being helped by data from the US Energy Information Administration released Wednesday showing that oil production in the country had fallen to its lowest level since September 2014. US production decreased by 113,000 barrels a day last week, marking the biggest weekly decline in output since July. US domestic output has now fallen for 11 consecutive weeks.

That further fall in production suggests that the markets are starting to address the supply-demand imbalance that has plagued markets and caused prices to fall from more than $100 a barrel in 2014 to as low as $27 in January.

Despite the good news from the EIA, however, oil inventories actually continued to grow last week. The EIA's Weekly Petroleum Status Report showed that US commercial crude inventories increased by 2.8 million barrels for the week that ended Friday.

Finally, news coming out of Saudi Arabia that the country has raised oil prices for export to Asia by the most in 14 months has also helped oil, Bloomberg reports. The move suggests that demand for crude is on the up, giving prices a further boost.

NOW WATCH: Here’s the one affordable habit ultra-successful people share

See Also:

The oil price rally could be 'sowing seeds of its own destruction'

The oil crash is causing a massive amount of layoffs in Saudi Arabia

• The ECB's 'aggressive stimulus' is finally driving a European recovery

Yahoo Finance

Yahoo Finance