How to hunt for solid yields in American shares

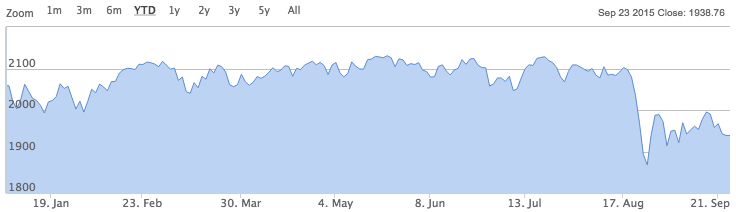

With the value of the S&P 500 down by around 7.8% since early August, this year is proving to be slow going for some of America’s largest stocks. But while equity prices have been under pressure in some parts of the market, one silver lining is that dividend yields on those shares have edged higher as a result. For income investors looking to diversify internationally, the recent pull-back in prices could offer the chance to pick up some of America’s most consistent dividend payers at improved valuations.

In recent weeks we’ve looked at ways of building a dividend strategy that combines yield, dividend safety and factors that target better quality businesses. That’s been based on some interesting (albeit limited) backtesting of what worked in dividend investing over the past year. As part of that we examined dividend growth here and looked how a myopic focus on yield, rather than the quality, value and momentum of a stock, might actually damage total returns here.

Dividend stocks at lower prices

In the United States, stock prices have enjoyed a multi-year bull run in the aftermath of the financial crisis. So it would be hard to argue that a sluggish 2015, with a pull back in August, has done much to unwind some racy valuations in places. But screening the US market for reasonable yields on shares in apparently strong, blue chip businesses, turns up a number of firms have suffered from fairly weak momentum in the recent past.

Searching for high yields in lower priced stocks is an approach that captures the spirit of Michael O’Higgins’ popular yield strategy known as Dogs of the Dow. His strategy works by simply buying the highest yielding shares in a blue chip index like the Dow Jones Industrial Index - or the S&P 500 or FTSE 100.

Part of the thinking behind the Dogs of the Dow approach is that high yield is a proxy for relative cheapness. As a share price falls, its yield rises, all other factors being equal. So the strategy targets firms that might be near the bottom of the business cycle and have seen their share prices fall as a result. Given that these stocks are generally well financed businesses with a well established, robust dividend history, the strategy bets that the dividends will remain intact. And when the business cycle improves, the share prices should rebound quickly.

Improving the Dogs of the Dow

Part of the problem with the strategy is that it ignores other safety measures and can end up with a portfolio that’s highly correlated between sectors. For instance, of the 10 shares currently qualifying for the Forecast Dividend Dogs strategy tracked by Stockopedia, the vast majority have, or are expected to have, dividend cover of less than 1x earnings. That’s a red flag to many dividend investors.

So how do you improve it? Well, we adapted one of the earlier screens from our dividend strategy experimentation. Among the key factors here are that we’re looking for reasonably high exposure to quality, value and momentum, with a minimum StockRank threshold of 80. We also looked for a track record of dividend growth, dividend cover of at least 1.2x earnings and forecasts that dividends will grow next year.

This approach undeniably results in a list of stocks on more modest yields than a straightforward Dogs of the Dow approach. But the extra safety rules offer a potentially improved basis for finding sustainable dividend yields that income investors crave.

Clearly there are individual companies here that are suffering as a result of cyclical down trends in their markets. Among the names that stand out is oil group Chevron, where a falling share price has caused the forecast yield on the stock to rise from 4.0% to 5.7% since the start of the year. But there are also some well known global brands. The forecast yield on Coca-Cola has risen from 3.1% to 3.6% through 2015, while Intel has seen its forward yield rise from 2.6% to 3.4%. Elsewhere, this year has seen a rise in the forecast yield of Johnson & Johnson from 2.8% to 3.3%, while the yield of IBM has risen from 2.9% to 3.4%.

Name | Mkt Cap £m | Stock Rank™ | Yield % | Div Cover | Div Streak | DPS Gwth % Forecast 1y |

93,969 | 80 | 5.62 | 1.51 | 10 | 2.23 | |

16,059 | 81 | 3.97 | 2.22 | 10 | 12.2 | |

60,167 | 82 | 3.45 | 1.28 | 10 | 5.43 | |

8,322 | 99 | 3.66 | 1.74 | 10 | 66.8 | |

110,612 | 82 | 3.28 | 1.34 | 10 | 8.70 | |

5,713 | 98 | 3.39 | 2.20 | 10 | 4.55 | |

168,921 | 94 | 3.06 | 1.99 | 10 | 6.22 | |

89,616 | 97 | 3.24 | 2.54 | 10 | 5.32 | |

92,317 | 92 | 3.20 | 3.26 | 10 | 10.9 | |

4,947 | 95 | 4.06 | 2.45 | 10 | 3.54 |

Combining yield and quality

With with S&P 500 trending sideways through most of 2015, and pulling back in recent weeks, improving yields could make it a market worth exploring further for income investors seeking international exposure. But while high yields have an obvious appeal for income investors, they can be a notorious signal of trouble - and a possible dividend cut - ahead. The addition of safety rules that consider the quality, value and momentum of the stock, the dividend cover and the strength of the dividend record may help to avoid the dreaded dividend trap.

Subscribers to Stockopedia US plans can see the dividend screen results here. Don’t forget you can also download our free guide to Getting Started in US Shares.

Read More about Chevron on Stockopedia

Discuss Chevron on Stockopedia

Yahoo Finance

Yahoo Finance