Hunt spends Budget windfall on childcare and tax breaks for wealthy pensioners

Jeremy Hunt has used a £25 billion-a-year improvement in the public finances to dramatically expand access to childcare and offer tax breaks to businesses and wealthy pensioners.

In a Budget aimed at increasing the numbers of people in work and the productivity of British firms, the Chancellor said the economy would avoid a recession and was “proving the doubters wrong”.

But the size of the economy is still forecast to shrink this year, living standards are the worst on record and the tax burden remains on course to be the highest since the Second World War.

Mr Hunt committed to spend more than £5.2 billion a year in 2027-28 on offering working parents in England up to 30 hours of funded childcare for pre-school children aged from nine months.

The move is expected to raise employment by 60,000 as it frees up parents to work, as well as “raising the hours worked by mothers already in work”, the Office for Budget Responsibility (OBR) said.

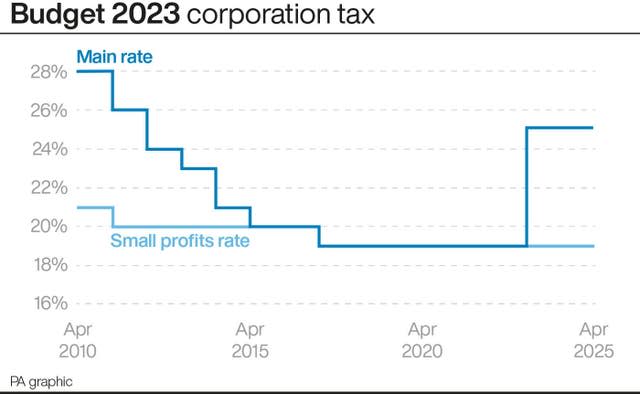

For businesses, a three-year temporary tax break will allow investment in plant and machinery to be written off against corporation tax – which will rise from 19p to 25p in April – costing £10.7 billion in 2024-25.

A multi-billion pound tax break on pensions is intended to stop an estimated 15,000 high earners – including senior NHS doctors – leaving the workforce.

Mr Hunt abolished the £1.07 million lifetime allowance – the total amount of tax-relieved contributions that an individual can accumulate – and increase the tax-free annual allowance from £40,000 to £60,000.

The measures will cost the Treasury more than £1.1 billion year by 2027/28, but the independent Institute for Fiscal Studies said it would have only a limited impact on employment.

IFS director Paul Johnson said they would “encourage a relatively small number of better-off workers to stay in the workforce a bit longer” while Labour leader Sir Keir Starmer branded it a “permanent tax cut … for the richest 1%”.

Mr Hunt committed to spend around two-thirds of the £25 billion a year improvement in the public finances.

The OBR said the economy would avoid a technical recession – two consecutive quarters of shrinkage – but it still forecast a contraction of 0.2% this year, a significant improvement on the -1.4% predicted in November.

The budget watchdog also upgraded its growth forecast for 2024 from 1.3% to 1.8%, but downgraded predictions for the following years to 2.5% in 2025, 2.1% in 2026 and 1.9% in 2027.

Underlying debt is forecast to be 92.4% of gross domestic product (GDP) next year, 93.7% in 2024-25; 94.6% in 2025-26, and 94.8% in 2026-27, before falling to 94.6% in 2027-28.

The deficit falls from 5.1% of GDP in 2023-24, to 3.2% in 2024-25, 2.8% in 2025-26, 2.2% in 2026-27 and 1.7% in 2027-28.

At £6.5bn, the Chancellor has given himself less headroom than any of his predecessors – just a quarter of the average of £26bn since 2010.#SpringBudget #Budget2023 pic.twitter.com/pGykeTNfpg

— Office for Budget Responsibility (@OBR_UK) March 15, 2023

Mr Hunt told MPs: “In the face of enormous challenges I report today on a British economy which is proving the doubters wrong.”

Later, he received a warm welcome from Tory MPs as he attended the backbench 1922 Committee.

Entering the meeting, he told reporters he would inform party colleagues “about the way this is going to help them win an election”.

“There is no path for us without a reputation for economic competence,” he said.

The childcare reforms will expand availability of funded hours from three and four-year-olds to younger children of working parents, saving them around £6,500 a year.

The policy in England will be implemented in phases but by September 2025 “every single working parent of under fives will have access to 30 hours free childcare per week”, Mr Hunt said.

There will also be an expansion of pre- and after-school clubs for older children, upfront payment of childcare costs to universal credit claimants, a relaxation of the ratios between staff and children, and incentives for people to become childminders.

Mr Hunt said the package was a “landmark reform” that would “help the economy, transform the lives of thousands of women and build a childcare system comparable to the best”.

The Chancellor resisted demands from Tory MPs, including Boris Johnson, to scrap April’s increase in corporation tax.

The move will contribute to the tax burden hitting a post-Second World War high of 37.7% in 2027-28, with the ratio of corporation tax receipts to GDP set to be the highest since the tax was introduced in 1965.

Mr Hunt promised “the most generous capital allowance regime of any advanced economy” to help offset some of the increase.

The Chancellor also used the improved economic picture to promise an extension of support for household bills, maintaining the energy price guarantee at its current £2,500 level from April to June.

It had been due to rise to £3,000 in April and the cost of scrapping the planned 20% increase will amount to about £3 billion.

In other measures:

– The fuel duty freeze and the 5p cut in its rate will be maintained for another year, saving the average driver around £100 at a cost of more than £5 billion this year.

– Taking advantage of tax flexibility since leaving the European Union, a “Brexit pubs guarantee” will see duty on draught pints up to 11p lower than in supermarkets, although drinkers will see tax on alcohol soar from August in line with inflation.

– Some 12 new investment zones will be created, offering up to £80 million of support each for tax breaks and incentives.

– Mr Hunt promised the “biggest change to our welfare system in a decade”, with reforms aimed at supporting more disabled people into work.

– There will be tougher sanctions for benefits claimants who fail to meet requirements to look for work or choose not to take up a reasonable job offer.

– Mr Hunt assigned an extra £10 million to charities on suicide prevention.

– He pledged £900 million for a new supercomputer to help harness the power of artificial intelligence, while £2.5 billion will go to a research and innovation programme for quantum computing.

Today, Jeremy Hunt should've matched the ambition of the British people.

Unlocked pride in every community.

Brought us together with purpose and intent.

All we got was sticking plaster politics.

Only Labour will deliver the long-term solutions our country needs. pic.twitter.com/M5bJUjuWGU

— Keir Starmer (@Keir_Starmer) March 15, 2023

The Budget took place against the backdrop of an estimated half a million workers, including junior doctors, teachers and civil servants, walking out in disputes over pay, jobs and conditions.

Shares in top European banks plummeted and the FTSE 100 of the UK’s biggest publicly listed companies dropped to the lowest level this year amid fears of a banking crisis.

Despite the promises of help with the cost of living, families still face a painful financial squeeze.

Living standards, based on real household disposable income (RHDI) per person, is expected to fall by a cumulative 5.7% over the two financial years 2022-23 and 2023-24 – less than forecast in November but still the largest since records began in 1956-57.

Sir Keir Starmer said: “After 13 years of his Government, our economy needed major surgery, but like millions across our country, this Budget leaves us stuck in the waiting room with only a sticking plaster to hand.

“A country set on a path of managed decline, falling behind our competitors, the sick man of Europe once again.”

The OBR said debt was falling “only by the narrowest of margins” in five years’ time, allowing Mr Hunt to meet his fiscal target, with around £4 billion of the £6.5 billion headroom linked to increasing fuel duty – something no chancellor has done since 2011.

Yahoo Finance

Yahoo Finance