Huntington Ingalls (HII) Q4 Earnings Miss, Revenues Rise Y/Y

Huntington Ingalls Industries, Inc.’s HII fourth-quarter 2022 earnings of $3.07 per share increased 2.7% from the $2.99 reported in the prior-year quarter. However, the bottom line missed the Zacks Consensus Estimate of $3.14 by 2.2%.

For the full-year 2022, HII reported earnings of $14.44 per share, which marginally missed the Zacks Consensus Estimate of $14.69.

Total Revenues

Total revenues came in at $2,812 million, beating the Zacks Consensus Estimate of $2,691.6 million by 4.5%. The top line also improved 5% from $2,677 million in the year-ago quarter.

For the full-year 2022, total revenues came in at $10.68 billion, beating the Zacks Consensus Estimate of $10.56 billion by 1.1%. Total revenues also increased 12.1% year over year.

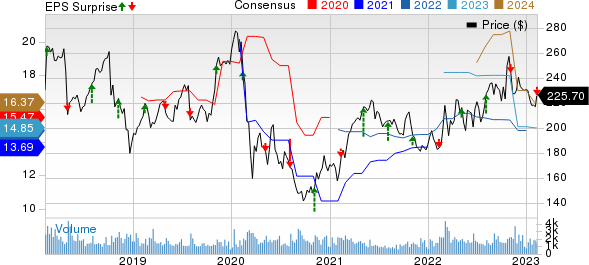

Huntington Ingalls Industries, Inc. Price, Consensus and EPS Surprise

Huntington Ingalls Industries, Inc. price-consensus-eps-surprise-chart | Huntington Ingalls Industries, Inc. Quote

Operational Performance

Huntington Ingalls reported an operating income of $145 million compared with $160 million in the fourth quarter of 2021. The company’s operating margin contracted 80 basis points from the prior-year quarter’s figure to 5.2%.

Huntington Ingalls received orders worth $3.2 billion in the fourth quarter. As a result, the company’s total backlog reached $47.1 billion as of Dec 31, 2022.

Segmental Performance

Newport News Shipbuilding: Revenues totaled $1,584 million in this segment, up 2.9% year over year due to higher revenues from aircraft carriers and submarines.

The segment reported operating earnings of $80 million in the quarter, which declined 15.8% year over year. The decrease was primarily due to lower-risk retirement on the VCS program and the construction of John F. Kennedy (CVN 79) compared to the prior-year period.

Ingalls Shipbuilding: Revenues in this segment totaled $658 million, up 13.3% year over year, primarily driven by higher revenues from surface combatants and amphibious assault ships. The segment’s operating income of $50 million improved 4.2% year over year.

Mission Technologies: Revenues in this segment totaled $602 million, up 2.7% year over year. The upside was primarily driven by growth in mission-based solutions.

The operating income declined 11.8% year over year to $15 million. The decrease in the segment operating income was primarily driven by a non-cash valuation adjustment of approximately $10 million.

Financial Update

The company’s cash and cash equivalents as of Dec 31, 2022 were $467 million, down from $627 million as of Dec 31, 2021.

The long-term debt as of Dec 31, 2022 was $2,506 million compared with the 2021-end level of $3,298 million. Cash outflow from operating activities in 2022 was $766 million compared to cash flow of $760 million during the end of 2021.

Guidance

Huntington Ingalls initiated its 2023 guidance. The company expects 2023 shipbuilding revenues in the range of $8.4-$8.6 billion.

For Mission Technologies, HII now expects revenues of approximately $2.5 billion. The company expects free cash flow in the band of $400-$450 million in 2023.

Zacks Rank

Huntington Ingalls currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Defense Releases

TransDigm Group Incorporated TDG reported first-quarter fiscal 2023 adjusted earnings of $4.58 per share, which beat the Zacks Consensus Estimate of $4.31 by 6.3%. The bottom line improved by a solid 52.7% from the prior-year reported figure of $3 per share.

Net sales amounted to $1,397 million in the fiscal first quarter, a 17% increase from $1,194 million in the prior-year quarter. The reported figure also beat the Zacks Consensus Estimate of $1,364 million by 2.4%.

General Dynamics Corporation GD reported a fourth-quarter 2022 EPS of $3.58, which beat the Zacks Consensus Estimate of $3.53 per share by 1.4%. Quarterly earnings increased 5.6% from $3.39 per share in the year-ago quarter.

General Dynamics’ fourth-quarter revenues of $10,851 million beat the Zacks Consensus Estimate of $10,674 million by 1.7%. Revenues also improved 5.4% from the year-ago quarter.

L3Harris Technologies, Inc.’s LHX fourth-quarter 2022 adjusted earnings from continuing operations came in at $3.27 per share, which beat the Zacks Consensus Estimate of $3.21 by 1.9%. However, the bottom line declined 0.9% from the year-ago quarter’s reported figure.

In the quarter under review, L3Harris’ revenues came in at $4,578 million, beating the Zacks Consensus Estimate of $4,333 million by 5.7%. Revenues rose 5.2% from the year-ago quarter’s $4,350 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Transdigm Group Incorporated (TDG) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance