Hyatt's (H) World of Hyatt to Launch Homes & Hideaways

Hyatt Hotels Corporation H has been planning on introducing Homes & Hideaways by World of Hyatt, a new short-term vacation rental platform, in the US. The launch is expected within the next few weeks.

Detailed Focus on the Launch

Homes & Hideaways will house private homes and remote hideaways in the country, ranging from beachfront escapes to mountainside ski chalet, in key travel destinations like Hawaii, Colorado, and more. The World of Hyatt members can have direct booking access across the unique and diversified collection of properties, and can earn as well as redeem points beyond the traditional hotel stay.

This launch is a stepping stone for Hyatt in unearthing yet another way of offering flexible stay experiences to its guests. It plans to expand this residential rental accommodation platform globally as well. The launch of Homes & Hideaways boosts the optimistic sentiments of the company as this unique collection of curated homes will expand its offerings as well as showcase a solid trajectory of key market growth and new opportunities.

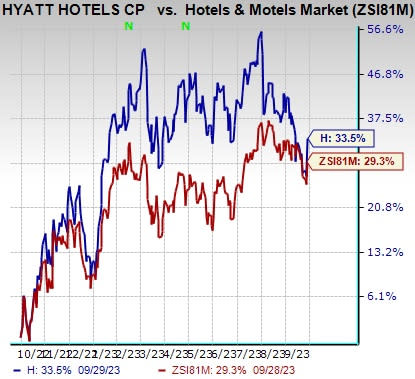

Image Source: Zacks Investment Research

Shares of Hyatt have gained 4.5% on Sep 28, during the trading session. Furthermore, the stock has increased 33.5% in the past year, outperforming the Zacks Hotels and Motels industry’s 29.3% growth.

Hyatt on Expansion Spree

Hyatt is consistently focusing on profitable strategies, which help it to expand its footprint and product offerings. Its expansion strategy primarily focuses on new property openings and accretive buyouts.

The company recently acquired Mr & Mrs Smith, a London-based platform, which offers direct booking access to more than 1500 boutique and luxury properties across the globe, primarily in Western Europe. This buyout will enhance the value offers for the owners of hotels represented on this platform, in alignment with the expansion of the choices for its members and guests. Moreover, it also acquired Dream Hotel Group for approximately $125 million. This acquisition will bring in the acquiree’s vivid portfolio of lifestyle hotel brands to Hyatt, thus helping it to expand its brand presence across destinations like Nashville, Hollywood, South Beach and New York City.

Furthermore, Hyatt has a solid portfolio of properties, from its globally recognized brands, lined up for launch through 2025. The new openings across U.S., Canada, Latin America and Caribbean, will diversify and expand its brand portfolio. It will also enable the World of Hyatt members to experience its signature luxury and lifestyle brands along with earn points and rewards during their stays.

Zacks Rank

Hyatt currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks from the Consumer Discretionary sector are Strategic Education, Inc. STRA, Live Nation Entertainment, Inc. LYV and Guess?, Inc. GES.

Strategic Education presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 12.1%, on average. The stock has gained 23.1% in the past year. The Zacks Consensus Estimate for STRA’s 2023 sales and earnings per share (EPS) indicates growth of 4.9% and 27.9%, respectively, from the year-ago period’s levels.

Live Nation presently sports a Zacks Rank of 1. LYV has a trailing four-quarter earnings surprise of 34.6%, on average. The stock has gained 10% in the past year.

The Zacks Consensus Estimate for LYV’s 2023 sales and EPS suggests rises of 21% and 57.8%, respectively, from the year-ago period’s levels.

Guess currently sports a Zacks Rank of 1. GES has a trailing four-quarter earnings surprise of 43.4%, on average. Shares of the company have increased 45% in the past year.

The Zacks Consensus Estimate for GES’ fiscal 2023 sales and EPS implies improvements of 3.7% and 9.9%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

Live Nation Entertainment, Inc. (LYV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance