IBM (NYSE:IBM) may offer an Opportunity despite Disappointing Returns

This article originally appeared on Simply Wall St News.

International Business Machines ( NYSE:IBM ) delivered another set of lackluster results on Wednesday when third quarter results were announced. While returns remain uninspiring, the current valuation may offer an opportunity.

Key numbers from the quarterly results included:

Revenue: US$17.6b (flat on 3Q 2020).

Net income: US$1.13b (down 34% from 3Q 2020).

Profit margin: 6.4% (down from 9.7% in 3Q 2020).

Large discrepancy between GAAP and non-GAAP EPS ($1.25 vs $2.52)

Annual change in revenue by business segment:

Global technology services down 5%.

Cloud and cognitive software up 2.5%

Global business services up 11.6%

Systems revenue down almost 12%.

How profitable is IBM?

There is no doubt that IBM’s growth has been negative over the last decade, and revenue is now less than a third of what it was in 2014. In fact, back in 2014 IBM’s net income was greater than the revenue it has earned over the last 12 months. But a company can still have value without growth if it is profitable. The tricky part is getting a sense of just how profitable the company is.

One measure of profitability that is often cited is ROE, or return on equity. IBM’s current ROE is 20.9% which is very respectable in it’s on right, and comfortably ahead of the US IT industry. However, when a company has a high level of debt, the ROE can be misleading.

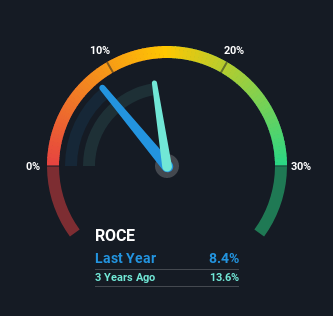

IBM’s debt to equity ratio is 2.43, which is indeed very high. In this case, the ROCE, or Return on Capital Employed can give a better indication of the type of return the company is generating on shareholder capital.

What is Return on Capital Employed (ROCE)?

ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on International Business Machines is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.085 = US$9.2b ÷ (US$144b - US$36b) (Based on the trailing twelve months to September 2021).

Therefore, International Business Machines has an ROCE of 8.5%. Ultimately, that's a low return and it under-performs the IT industry average of 12%.

View our latest analysis for International Business Machines

In the above chart we have measured International Business Machines' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering International Business Machines here for free.

What can we tell from IBM’s' ROCE Trend?

When we looked at the ROCE trend at International Business Machines, we didn't gain much confidence. To be more specific, ROCE has fallen from 18% over the last five years. Meanwhile, the business is utilizing more capita,l but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

Better Times Ahead for IBM?

IBM has been on the verge of a turnaround for years, but the situation remains uninspiring. However, it may still be worth keeping an eye on the stock as there are a few positives to consider:

The least profitable parts of the business, and which acted as the biggest drag on recent results, are due to be spun-off. Shareholders will receive shares in Kyndryl, which includes IBM’s managed infrastructure business, when it separates in November.

The spinoff will leave IBM to focus on its cloud and artificial intelligence businesses, both of which have higher growth potential and better margins. However, the company’s leadership still expects revenue growth to remain in the single digits for the next few years.

Despite declining revenue, IBM still generates free cash flow of around $13 billion, and is reasonably valued. Our estimates of the fair value, which accounts for declining cash flows, is $202. This implies the share is currently trading at a 36% discount.

The dividend yield of 5% is both generous and well covered by cash flows.

IBM’s stock price provides optionality on an improving outlook at a reasonable price. If you believe the growth outlook can improve, the stock may be offering an attractive opportunity.

Note: There are a few other important warning signs for International Business Machines that we haven’t covered here, and that you should be aware of.

For those who like to invest in solid companies , check out this free list of companies with solid balance sheets and high returns on equity.

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance